NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET FORECAST 2018-2026

North America Commercial Vehicle Telematics Market Is Segmented by Provider (Aftermarket, Original Equipment Manufacturers (OEM)) by Type (Service, Solutions) by End Users(Construction, Government & Utilities, Healthcare, Media & Entertainment, Transportation & Logistics, Travel & Tourism, Other End Users)

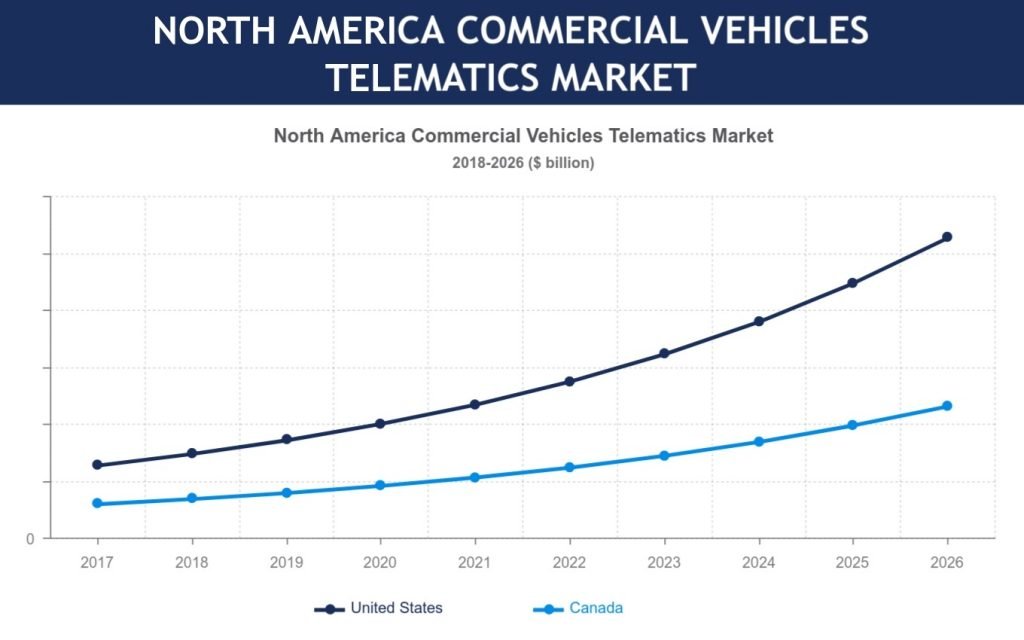

North America commercial vehicle telematics market is developing and expanding at a significant pace. Therefore, over the forecasted period of 2018-2026, the market is predicted to exhibit a CAGR of 16.95%.

To learn more about this report, request a free sample copy

Countries such as the United States and Canada are mainly focused in this report. Growing incidences of vehicle thefts is a major driver for the US commercial vehicle telematics market; which has augmented the need for the installation & adoption of telematics systems that are equipped with features like vehicle tracking, driver assistance system and remote theft alarm. Canada, too, is witnessing increased adoption of such advanced vehicle telematics. For instance, the Mojio Organization in Canada offers a combined software & hardware system which acts as a Wi-Fi hotspot for commercial vehicles drivers to remotely identify their vehicle location & provides information about the ongoing mechanical problems in the vehicle.

Some of the key market players operating in commercial vehicle telematics market region include Msd Telematics Pvt. Ltd, Volkswagen Commercial Vehicles, Microlise Group Ltd, Ptc Inc, Harman International, Omnitracs Llc, Masternaut Ltd, At&T Inc, Octo Telematics Ltd, Zonar System Inc, Mix Telematics International, Verizon Connect Inc, and Inseego Corp.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- NORTH AMERICA DOMINATES THE OVERALL COMMERCIAL VEHICLE TELEMATICS MARKET

- AFTERMARKET IN THE PROVIDER SEGMENT LEADS THE MARKET

- COMMERCIAL VEHICLE TELEMATICS SOLUTIONS ACCOUNTED FOR LARGEST REVENUE SHARE

- LOGISTICS & TRANSPORTATION – KEY END-USER INDUSTRY

- INCREASING INCORPORATION OF TELEMATICS BY AUTOMOBILE MANUFACTURERS (OEM)

- MARKET DYNAMICS

- PARENT MARKET ANALYSIS: VEHICLE TELEMATICS MARKET

- ETYMOLOGY OF COMMERCIAL VEHICLE TELEMATICS

- MARKET DEFINITION & SCOPE

- DRIVERS

- NOTABLE INVESTMENTS IN VEHICLE TELEMATICS ACROSS THE GLOBE

- INCREASING SMARTPHONE PENETRATION ACROSS THE GLOBE

- GOVERNMENT INITIATIVES AND INVESTMENTS FOR THE DEPLOYMENT OF VEHICLE TRACKING

- HIGH ADOPTION OF NEXT GENERATION TELEMATICS PROTOCOL (NGTP) IN COMMERCIAL VEHICLES

- RESTRAINTS

- GROWING RISKS AND CONCERNS ASSOCIATED WITH SECURITY AND PRIVACY

- TECHNOLOGICAL CHALLENGES

- OPPORTUNITIES

- INCREASED PRODUCTION OF COMMERCIAL VEHICLES

- WIDENING APPLICATIONS OF TELEMATICS IN BUSINESS SECTOR

- INTRODUCTION OF ELECTRONIC LOGGING DEVICE (ELD) MANDATE IN THE COMMERCIAL VEHICLES

- CHALLENGES

- LACK OF STANDARDIZATION

- PROBLEMS ASSOCIATED WITH NETWORK COVERAGE AND BLIND SPOTS

- MARKET BY PROVIDER

- AFTERMARKET

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- MARKET BY TYPE

- SERVICE

- PROFESSIONAL SERVICE

- MANAGED SERVICE

- SOLUTIONS

- SMART FLEET MANAGEMENT

- DRIVER MANAGEMENT

- INSURANCE TELEMATICS

- SAFETY & COMPLIANCE

- V2X SOLUTIONS

- OTHER SOLUTIONS

- SERVICE

- MARKET BY END USERS

- CONSTRUCTION

- GOVERNMENT & UTILITIES

- HEALTHCARE

- MEDIA & ENTERTAINMENT

- TRANSPORTATION & LOGISTICS

- TRAVEL & TOURISM

- OTHER END USERS

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF COMPETITIVE RIVALRY

- KEY BUYING CRITERIA

- RELIABILITY

- PRICE

- FEATURES

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- VALUE CHAIN ANALYSIS

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- DEVICE MANUFACTURERS

- INFRASTRUCTURE & INTERNET COMPANIES

- SOFTWARE SERVICES

- LEGAL, POLICY & REGULATORY FRAMEWORK

- INVESTMENT ANALYSIS

- BY END USERS

- BY TYPE

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- UNITED STATES

- CANADA

- COMPETITIVE LANDSCAPE

- MARKET SHARE ANALYSIS

- KEY COMPANY ANALYSIS

- TRIMBLE INC.

- TOMTOM TELEMATICS BV

- VERIZON TELEMATICS INC.

- MIX TELEMATICS INTERNATIONAL

- OMNITRACS LLC

- CORPORATE STRATEGIES

- PRODUCT LAUNCH

- PARTNERSHIP & COLLABORATION

- MERGER & ACQUISITION

- OTHER KEY STRATEGIES

- COMPANY PROFILES

- AT&T INC.

- HARMAN INTERNATIONAL

- INSEEGO CORP.

- MASTERNAUT LTD

- MICROLISE GROUP LTD.

- MIX TELEMATICS INTERNATIONAL

- MSD TELEMATICS PVT. LTD

- OCTO TELEMATICS LTD.

- OMNITRACS LLC

- PTC INC.

- TOMTOM TELEMATICS BV

- TRIMBLE INC.

- VERIZON CONNECT INC.

- VOLKSWAGEN COMMERCIAL VEHICLES

- ZONAR SYSTEM INC.

TABLE LIST

TABLE 1: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY COUNTRY, 2018-2026 (IN $ BILLION)

TABLE 2: NOTABLE INVESTMENTS IN VEHICLE TELEMATICS

TABLE 3: VULNERABILITY OF AUTOMOTIVE CYBER-ATTACKS THROUGH WIRED OR WIRELESS MEDIUM

TABLE 4: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY PROVIDER, 2018-2026, (IN $ BILLION)

TABLE 5: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY TYPE, 2018-2026, (IN $ BILLION)

TABLE 6: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY SERVICE, 2018-2026 (IN $ BILLION)

TABLE 7: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY SOLUTIONS, 2018-2026 (IN $ BILLION)

TABLE 8: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY END USERS, 2018-2026, (IN $ BILLION)

TABLE 9: OPPORTUNITY MATRIX FOR COMMERCIAL VEHICLE TELEMATICS MARKET

TABLE 10: VENDOR LANDSCAPE OF COMMERCIAL VEHICLE TELEMATICS MARKET

TABLE 11: LEGAL, POLICY & REGULATORY FRAMEWORK

TABLE 12: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY COUNTRY, 2018-2026 (IN $ BILLION)

TABLE 13: LIST OF PRODUCT LAUNCH

TABLE 14: LIST OF PARTNERSHIP & COLLABORATION

TABLE 15: LIST OF MERGERS & ACQUISITIONS

TABLE 16: OTHER KEY STRATEGIES

FIGURE LIST

FIGURE 1: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY PROVIDER, 2018-2026 (IN %)

FIGURE 2: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, 2018-2026 (IN $ BILLION)

FIGURE 3: TIMELINE OF COMMERCIAL VEHICLE TELEMATICS

FIGURE 4: ADOPTION OF SMARTPHONE ACROSS THE GLOBE IN 2016 (IN %)

FIGURE 5: PRODUCTION STATISTICS OF COMMERCIAL VEHICLE, 2009-2015 (IN THOUSAND UNITS)

FIGURE 6: TOP COUNTRY WISE PRODUCTION OF COMMERCIAL VEHICLES IN 2016 (IN THOUSAND UNITS)

FIGURE 7: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY AFTERMARKET, 2018-2026 (IN $ BILLION)

FIGURE 8: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY ORIGINAL EQUIPMENT MANUFACTURERS (OEM), 2018-2026 (IN $ BILLION)

FIGURE 9: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY SERVICE, 2018-2026 (IN $ BILLION)

FIGURE 10: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY PROFESSIONAL SERVICE, 2018-2026 (IN $ BILLION)

FIGURE 11: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY MANAGED SERVICE, 2018-2026 (IN $ BILLION)

FIGURE 12: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY SOLUTIONS, 2018-2026 (IN $ BILLION)

FIGURE 13: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY SMART FLEET MANAGEMENT, 2018-2026 (IN $ BILLION)

FIGURE 14: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY DRIVER MANAGEMENT, 2018-2026 (IN $ BILLION)

FIGURE 15: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY INSURANCE TELEMATICS, 2018-2026 (IN $ BILLION)

FIGURE 16: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY SAFETY & COMPLIANCE, 2018-2026 (IN $ BILLION)

FIGURE 17: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY V2X SOLUTIONS, 2018-2026 (IN $ BILLION)

FIGURE 18: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY OTHER SOLUTIONS, 2018-2026 (IN $ BILLION)

FIGURE 19: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY CONSTRUCTION, 2018-2026 (IN $ BILLION)

FIGURE 20: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY GOVERNMENT & UTILITIES, 2018-2026 (IN $ BILLION)

FIGURE 21: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY HEALTHCARE, 2018-2026 (IN $ BILLION)

FIGURE 22: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY MEDIA & ENTERTAINMENT, 2018-2026 (IN $ BILLION)

FIGURE 23: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY TRANSPORTATION & LOGISTICS, 2018-2026 (IN $ BILLION)

FIGURE 24: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY TRAVEL TOURISM, 2018-2026 (IN $ BILLION)

FIGURE 25: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, BY OTHER END USERS, 2018-2026 (IN $ BILLION)

FIGURE 26: PORTER’S FIVE FORCE MODEL OF COMMERCIAL VEHICLE TELEMATICS MARKET

FIGURE 27: KEY BUYING IMPACT ANALYSIS

FIGURE 28: RELATIONSHIP BETWEEN DIRECT & INDIRECT COST

FIGURE 29: VALUE CHAIN OF COMMERCIAL VEHICLE TELEMATICS MARKET

FIGURE 30: INVESTMENT ANALYSIS OF COMMERCIAL VEHICLE TELEMATICS MARKET IN 2017, BY END USERS

FIGURE 31: INVESTMENT ANALYSIS OF COMMERCIAL VEHICLE TELEMATICS MARKET IN 2017, BY SERVICES

FIGURE 32: NORTH AMERICA COMMERCIAL VEHICLE TELEMATICS MARKET, REGIONAL OUTLOOK, 2017 & 2026 (IN %)

FIGURE 33: UNITED STATES COMMERCIAL VEHICLE TELEMATICS MARKET, 2018-2026 (IN $ BILLION)

FIGURE 34: CANADA COMMERCIAL VEHICLE TELEMATICS MARKET, 2018-2026 (IN $ BILLION)

FIGURE 35: MARKET SHARE ANALYSIS OF KEY PLAYERS IN 2017 (IN %)

- GEOGRAPHICAL ANALYSIS

- UNITED STATES

- CANADA

- MARKET BY PROVIDER

- AFTERMARKET

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- MARKET BY TYPE

- SERVICE

- PROFESSIONAL SERVICE

- MANAGED SERVICE

- SOLUTIONS

- SMART FLEET MANAGEMENT

- DRIVER MANAGEMENT

- INSURANCE TELEMATICS

- SAFETY & COMPLIANCE

- V2X SOLUTIONS

- OTHER SOLUTIONS

- SERVICE

- MARKET BY END USERS

- CONSTRUCTION

- GOVERNMENT & UTILITIES

- HEALTHCARE

- MEDIA & ENTERTAINMENT

- TRANSPORTATION & LOGISTICS

- TRAVEL & TOURISM

- OTHER END USERS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.