NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET FORECAST 2020-2028

North America Biotechnology Reagents Market by Application (Protein Synthesis & Purification, Gene Expression, DNA & RNA Analysis, Drug Testing) by Technology (Life Science Reagents, Analytical Reagents) by Geography.

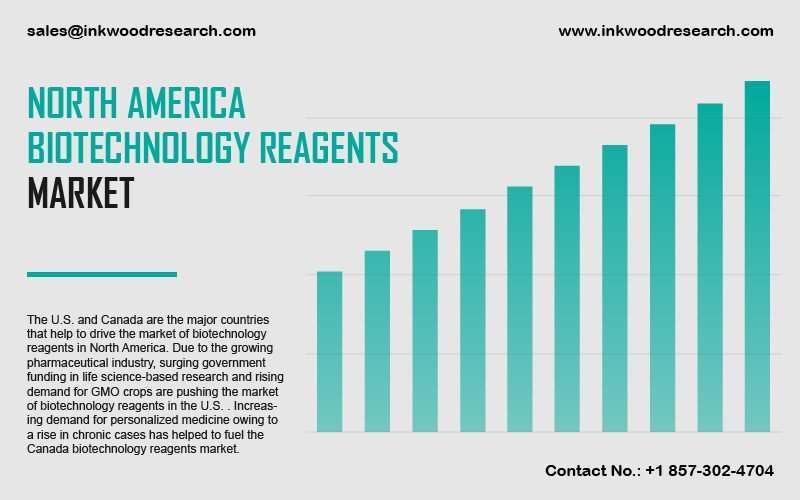

The North American biotechnology reagents market is expected to reach a CAGR of 6.50% during the forecast period of 2020-2028. The US and Canada are the major countries that drive the biotechnology reagents market in North America. The growing pharmaceutical industry, and the government funding in life science-based research, are the factors propelling market growth.

To know more about this report, request a free sample copy.

The region of North America is divided into the US and Canada to understand the biotechnology reagents market better. In the US, there are huge funding provided by the government for biomedical and life science-based research, which is a key driver for market growth. The growing demand for personalized medicines due to a rise in chronic diseases like diabetes, cancer, etc.is helping to propel the US biotechnology reagents market during the forecast period. An important factor surging the overall biotechnology sector in the region of North America is the increased expenditure on research and development by various biotech companies. There are market restraints, as well. Due to environmental concerns, the United States has passed a new act for chemical safety, which makes it compulsory for EPA to evaluate obtainable chemicals with clear and enforceable deadlines.

Abbott Laboratories, headquartered in Abbott Park, Illinois, the US, is a leading pharmaceutical company in the market manufacturing, selling, and marketing healthcare products. The company operates in the regions of the US, Japan, Germany, India, the Netherlands, Switzerland, China, and other regions.

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- MARKET DRIVERS

- LARGE INVESTMENT IN BIOTECHNOLOGY BY THE CORPORATES AND RESEARCH ORGANIZATIONS

- EVOLVING LANDSCAPE OF THE BIOTECHNOLOGY INDUSTRY

- INCREASING PROTEIN PROFILING APPLICATIONS

- MARKET RESTRAINTS

- HIGH COST OF BIOPHARMACEUTICAL RESEARCH AND DRUG DEVELOPMENT

- CONTAMINATION ISSUES

- REGULATORY DIFFERENCE IN VARIOUS COUNTRIES

- KEY ANALYTICS

- PORTER’S FIVE FORCE ANALYSIS

- NEW ENTRANTS

- SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- INDUSTRY RIVALRY

- KEY BUYING CRITERIA

- SUSTAINABILITY

- QUALITY OF PRODUCT

- COST

- AVAILABILITY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- MARKET BY APPLICATION

- PROTEIN SYNTHESIS & PURIFICATION

- GENE EXPRESSION

- DNA & RNA ANALYSIS

- DRUG TESTING

- MARKET BY TECHNOLOGY

- LIFE SCIENCE REAGENTS

- PCR

- MASTER MIXES

- PCR REAGENT KIT

- CELL CULTURE

- SERA

- MEDIA AND REAGENTS

- INVITRO DIAGNOSTIC

- EXPRESSION AND TRANSFECTION

- PCR

- ANALYTICAL REAGENTS

- CHROMATOGRAPHY

- MASS SPECTROMETRY

- ELECTROPHORESIS

- FLOW CYTOMETRY

- LIFE SCIENCE REAGENTS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- NORTH AMERICA

- COMPANY PROFILES

- ABBOTT LABORATORIES

- AGILENT TECHNOLOGIES INC.

- BECTON, DICKINSON & COMPANY (BD)

- BIO-RAD LABORATORIES INC.

- BIO-TECHNE CORPORATION

- CORNING INC.

- GE HEALTHCARE

- INVIVOSCRIBE TECHNOLOGIES INC

- LONZA GROUP LTD.

- MERCK KGAA

- MERIDIAN BIOSCIENCE INC

- PERKINELMER

- PROMOCELL GMBH

- SIGNALCHEM LIFESCIENCES CORPORATION

- VWR CORPORATION (PART OF AVANTOR)

TABLE LIST

TABLE 1: BIOTECHNOLOGY REAGENTS MARKET AT A GLANCE/MARKET SNAPSHOT/MARKET SUMMARY

TABLE 2: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY APPLICATION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 4: NORTH AMERICA PROTEIN SYNTHESIS & PURIFICATION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: NORTH AMERICA PROTEIN SYNTHESIS & PURIFICATION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 6: NORTH AMERICA GENE EXPRESSION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: NORTH AMERICA GENE EXPRESSION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 8: NORTH AMERICA DNA & RNA ANALYSIS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: NORTH AMERICA DNA & RNA ANALYSIS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 10: NORTH AMERICA DRUG TESTING MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: NORTH AMERICA DRUG TESTING MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 12: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY TECHNOLOGY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY TECHNOLOGY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 14: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 16: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 18: NORTH AMERICA PCR MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: NORTH AMERICA PCR MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 20: NORTH AMERICA PCR MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: NORTH AMERICA PCR MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 22: NORTH AMERICA MASTER MIXES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: NORTH AMERICA MASTER MIXES MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 24: NORTH AMERICA PCR REAGENT KIT MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 25: NORTH AMERICA PCR REAGENT KIT MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 26: NORTH AMERICA CELL CULTURE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 27: NORTH AMERICA CELL CULTURE MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 28: NORTH AMERICA CELL CULTURE MARKET, BY TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 29: NORTH AMERICA CELL CULTURE MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 30: NORTH AMERICA SERA MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 31: NORTH AMERICA SERA MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 32: NORTH AMERICA MEDIA AND REAGENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 33: NORTH AMERICA MEDIA AND REAGENTS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 34: NORTH AMERICA INVITRO DIAGNOSTIC MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 35: NORTH AMERICA INVITRO DIAGNOSTIC MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 36: NORTH AMERICA EXPRESSION AND TRANSFECTION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 37: NORTH AMERICA EXPRESSION AND TRANSFECTION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 38: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 39: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 40: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY TYPE HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 41: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 42: NORTH AMERICA CHROMATOGRAPHY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 43: NORTH AMERICA CHROMATOGRAPHY MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 44: NORTH AMERICA MASS SPECTROMETRY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 45: NORTH AMERICA MASS SPECTROMETRY MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 46: NORTH AMERICA ELECTROPHORESIS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 47: NORTH AMERICA ELECTROPHORESIS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 48: NORTH AMERICA FLOW CYTOMETRY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 49: NORTH AMERICA FLOW CYTOMETRY MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 50: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 51: NORTH AMERICA BIOTECHNOLOGY REAGENTS, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

FIGURE LIST

FIGURE 1: PORTER’S FIVE FORCE ANALYSIS

FIGURE 2: KEY BUYING CRITERIA

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE OF BIOTECHNOLOGY REAGENTS MARKET

FIGURE 5: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET GROWTH POTENTIAL, BY APPLICATION, 2019

FIGURE 6: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, BY PROTEIN SYNTHESIS & PURIFICATION, 2020-2028 (IN $ MILLION)

FIGURE 7: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, BY GENE EXPRESSION, 2020-2028 (IN $ MILLION)

FIGURE 8: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, BY DNA & RNA ANALYSIS, 2020-2028 (IN $ MILLION)

FIGURE 9: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, BY DRUG TESTING, 2020-2028 (IN $ MILLION)

FIGURE 10: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET GROWTH POTENTIAL, BY TECHNOLOGY, 2019

FIGURE 11: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, BY LIFE SCIENCE REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 12: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY PCR, 2020-2028 (IN $ MILLION)

FIGURE 13: NORTH AMERICA PCR MARKET, BY MASTER MIXES, 2020-2028 (IN $ MILLION)

FIGURE 14: NORTH AMERICA PCR MARKET, BY PCR REAGENT KIT, 2020-2028 (IN $ MILLION)

FIGURE 15: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY CELL CULTURE, 2020-2028 (IN $ MILLION)

FIGURE 16: USE OF ANIMAL SERUM MEDIA IN THE STUDY OF MESENCHYMAL STROMAL CELLS IN CELL CULTURE

FIGURE 17: NORTH AMERICA CELL CULTURE MARKET, BY SERA, 2020-2028 (IN $ MILLION)

FIGURE 18: NORTH AMERICA CELL CULTURE MARKET, BY MEDIA AND REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 19: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY INVITRO DIAGNOSTIC, 2020-2028 (IN $ MILLION)

FIGURE 20: NORTH AMERICA LIFE SCIENCE REAGENTS MARKET, BY EXPRESSION AND TRANSFECTION, 2020-2028 (IN $ MILLION)

FIGURE 21: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, BY ANALYTICAL REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 22: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY CHROMATOGRAPHY, 2020-2028 (IN $ MILLION)

FIGURE 23: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY MASS SPECTROMETRY, 2020-2028 (IN $ MILLION)

FIGURE 24: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY ELECTROPHORESIS, 2020-2028 (IN $ MILLION)

FIGURE 25: NORTH AMERICA ANALYTICAL REAGENTS MARKET, BY FLOW CYTOMETRY, 2020-2028 (IN $ MILLION)

FIGURE 26: NORTH AMERICA BIOTECHNOLOGY REAGENTS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 27: THE UNITED STATES BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

FIGURE 28: CANADA BIOTECHNOLOGY REAGENTS, 2020-2028 (IN $ MILLION)

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- NORTH AMERICA

- MARKET BY APPLICATION

- PROTEIN SYNTHESIS & PURIFICATION

- GENE EXPRESSION

- DNA & RNA ANALYSIS

- DRUG TESTING

- MARKET BY TECHNOLOGY

- LIFE SCIENCE REAGENTS

- PCR

- MASTER MIXES

- PCR REAGENT KIT

- CELL CULTURE

- SERA

- MEDIA AND REAGENTS

- INVITRO DIAGNOSTIC

- EXPRESSION AND TRANSFECTION

- PCR

- ANALYTICAL REAGENTS

- CHROMATOGRAPHY

- MASS SPECTROMETRY

- ELECTROPHORESIS

- FLOW CYTOMETRY

- LIFE SCIENCE REAGENTS

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.