GLOBAL HYDROGEL MARKET FORECAST 2019-2028

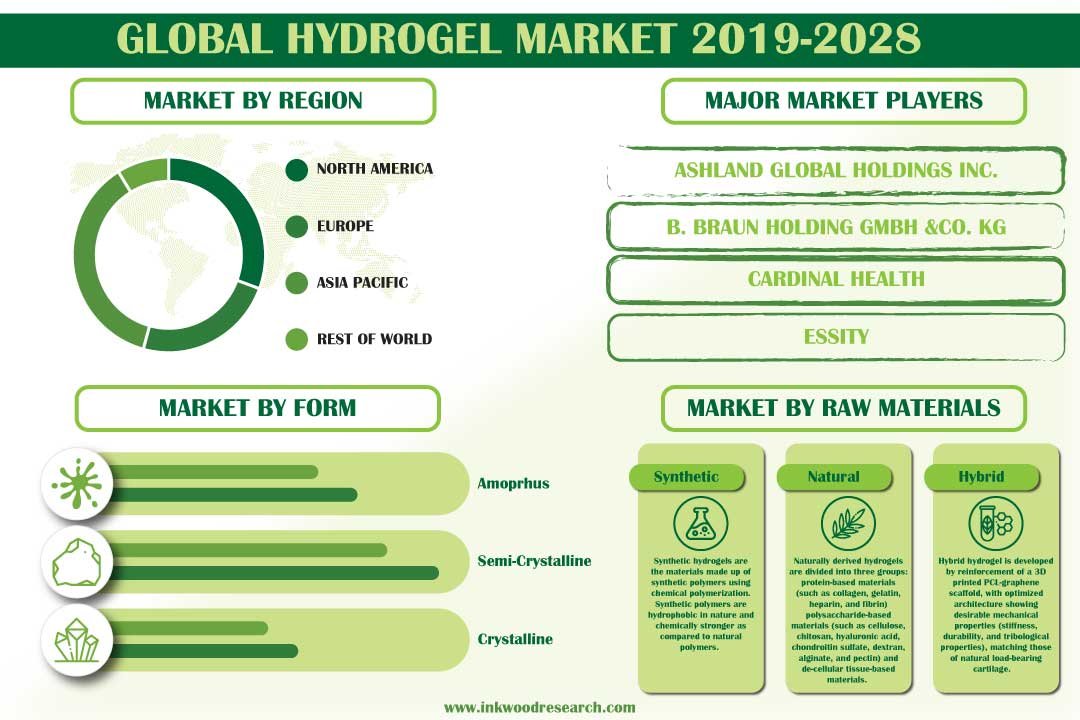

Global Hydrogel Market by Form (Amorphous Hydrogels, Semi-crystalline Hydrogels, Crystalline Hydrogels) by Raw Materials (Synthetic, Natural, Hybrid Hydrogels) by Composition (Polyacrylate, Polyacrylamide, Silicone-modified Hydrogels, Agar-based, Others) by Product (Semi-crystalline Buttons, Amorphous Gels, Impregnated Gauze, Films & Matrices, Hydrogel Sheets) by End-user (Contact Lenses, Hygiene Products, Wound Care, Drug Delivery, Tissue Engineering, Others) and by Geography.

Inkwood Research anticipates that the global hydrogel market will reach $35.05 billion by 2028, growing at a CAGR of 5.88% during the forecast period. The base year considered is 2018, and the forecasted period is between 2019 and 2028.

The hydrogel is interlinked with 3D polymeric structures, which can retain and absorb significant amounts of water. It is used for products such as medication delivery systems, sanitation, packaging, food additives, coal dewatering, nutrition, and tissue engineering.

To know more about this report, request a free sample copy

Key market enablers for the global hydrogel market are:

- Wide range of applications

- Growing demand for synthetic hydrogels for research

- Growth in personal care & hygiene sector

- There is an increase in awareness of hygiene, coupled with growing infants and aging population in emerging economies, and continued demand for female hygiene products. Furthermore, growth in use and acceptance of eyewear products driven by changing lifestyles, is expected to boost the use of hydrogel for contact lens.

- Upsurge in chronic conditions

Key restraining factors of market growth are:

- Environmental hazard

- High production cost

- One of the main reasons for the high cost is the expenses involved in making expensive peptides. Some novel processes are being developed, which may require low prices than the costs needed for production using more expensive processes, such as photolithography.

The report on the global hydrogel market includes the segmentation analysis of raw materials, composition, form, product, and end-user.

Market by End-user:

- Contact Lenses

- Contact lenses garnered the major market share in 2019. The rising emphasis on the fashion industry on the aesthetic look and popularity of color contact lenses boost the market of these products. In addition, the latest line of soft lens material technologies is silicone hydrogels, which aim to increase comfort, improve eye health, longer wear, and contact lens clinical performance.

- Hygiene Products

- Wound Care

- Wound care is set to project the highest CAGR by 2028. The main purpose of using hydrogels in wound dressing is to provide a moist environment at the place of the wound. The growing global diabetic & obese population and burn incidences, changes in people’s lifestyle, rising governmental funds on research and developments, increasing awareness, and adaptation to new technology.

- Drug Delivery

- Tissue Engineering

- Others

Geographically, the global hydrogel market has been segmented on the basis of four major regions, which includes:

- North America: the United States and Canada

- Europe: the United Kingdom, Germany, France, Italy, Russia, Belgium, Poland, and Rest of Europe

- Asia Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia Pacific

- The Asia Pacific is the dominant as well as the fastest-growing region for the hydrogel market during the forecast period.

- Hydrogel has attracted a large government and non-government funding in the Asia Pacific, due to its various advantages and applications. Therefore, a lot of research is being carried out in the healthcare, pharmaceutical, and agricultural sectors.

- Rest of World: Latin America, the Middle East & Africa

The major players in the global hydrogel market are:

- Ashland

- Smith & Nephew Plc

- Cardinal Health

- Paul Hartmann

- Procyon Corporation

- Braun Holding GmbH & Co. Kg

- Others

Key strategies adopted by some of these companies:

In August 2019, the HARTMANN Group acquired Safran Coating. With this acquisition, the R&D capabilities of both companies will further boost the performance of wound care products. This acquisition has enhanced the product portfolio of the company and strengthened its presence in Europe.

Key findings of the global hydrogel market:

- The growing geriatric population base and an increase in trend among youngsters to enhance their aesthetic appearance are the major drivers that boost demand for contact lenses.

- Polyacrylamide is set to be the fastest-growing composition during the forecasted period.

- Emerging markets possess high growth potential due to the availability of improved healthcare infrastructure, unmet healthcare needs, and a rise in the incidence of burn, diabetes, and ulcer.

- Advancements in new methods of shaping homo- and co-polymeric synthetic hydrogels to be used in protein delivery, peptides, and drug applications is the key factor that increases the use of synthetic hydrogels.

Frequently Asked Questions & Answers (FAQ):

- Which product is projected to grow with the fastest CAGR?

A: Impregnated gauze is set to be the fastest-growing product.

- Which are the regulatory bodies with regard to the market under study?

A: Food and Drug Administration (FDA) is the regulatory body for the hydrogel market.

- How has COVID-19 impacted the market?

A: Yes, there has been an economic impact in the market, due to the halt of several industries, especially the transport and supply chain.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- WIDE RANGE OF APPLICATIONS

- GROWING DEMAND FOR SYNTHETIC HYDROGELS FOR RESEARCH

- GROWTH IN PERSONAL CARE & HYGIENE SECTOR

- UPSURGE IN CHRONIC CONDITIONS

- KEY RESTRAINTS

- ENVIRONMENTAL HAZARD

- HIGH PRODUCTION COST

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY FORM

- AMORPHOUS HYDROGELS

- SEMI-CRYSTALLINE HYDROGELS

- CRYSTALLINE HYDROGELS

- MARKET BY RAW MATERIALS

- SYNTHETIC

- NATURAL

- HYBRID HYDROGELS

- MARKET BY COMPOSITION

- POLYACRYLATE

- POLYACRYLAMIDE

- SILICONE-MODIFIED HYDROGELS

- AGAR-BASED

- OTHERS

- MARKET BY PRODUCT

- SEMI-CRYSTALLINE BUTTONS

- AMORPHOUS GELS

- IMPREGNATED GAUZE

- FILMS & MATRICES

- HYDROGEL SHEETS

- MARKET BY END-USER

- CONTACT LENSES

- HYGIENE PRODUCTS

- WOUND CARE

- DRUG DELIVERY

- TISSUE ENGINEERING

- OTHERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- ASHLAND GLOBAL HOLDINGS INC

- BRAUN HOLDING GMBH &CO KG

- CARDINAL HEALTH

- ESSITY

- MEDLINE INDUSTRIES INC

- PAUL HARTMAN

- PROCYON CORPORATION

- SMITH & NEPHEW

- THE COOPER COMPANIES

- 3M COMPANY

- JOHNSON & JOHNSON

- ROYAL DSM

- MEDTRONIC PLC

- DOW CORNING

- MOMENTIVE PERFORMANCE MATERIALS

- DERMA SCIENCES

- COLOPLAST

- HOYA CORPORATION

- INTEGRA LIFESCIENCES

- ALCON ( NOVARTIS AG)

TABLE LIST

TABLE 1: MARKET SNAPSHOT – HYDROGEL

TABLE 2: GLOBAL HYDROGEL MARKET, BY FORM, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: GLOBAL HYDROGEL MARKET, BY FORM, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: GLOBAL AMORPHOUS HYDROGELS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: GLOBAL AMORPHOUS HYDROGELS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: GLOBAL SEMI-CRYSTALLINE HYDROGELS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: GLOBAL SEMI-CRYSTALLINE HYDROGELS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: GLOBAL CRYSTALLINE HYDROGELS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: GLOBAL CRYSTALLINE HYDROGELS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 10: GLOBAL HYDROGEL MARKET, BY RAW MATERIALS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: GLOBAL HYDROGEL MARKET, BY RAW MATERIALS, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 12: GLOBAL SYNTHETIC MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: GLOBAL SYNTHETIC MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 14: GLOBAL NATURAL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: GLOBAL NATURAL MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 16: GLOBAL HYBRID HYDROGELS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: GLOBAL HYBRID HYDROGELS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 18: GLOBAL HYDROGEL MARKET, BY COMPOSITION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: GLOBAL HYDROGEL MARKET, BY COMPOSITION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 20: GLOBAL POLYACRYLATE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: GLOBAL POLYACRYLATE MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 22: GLOBAL POLYACRYLAMIDE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: GLOBAL POLYACRYLAMIDE MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 24: GLOBAL SILICONE-MODIFIED HYDROGELS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 25: GLOBAL SILICONE-MODIFIED HYDROGELS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 26: GLOBAL AGAR-BASED MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 27: GLOBAL AGAR-BASED MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 28: GLOBAL OTHERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 29: GLOBAL OTHERS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 30: GLOBAL HYDROGEL MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 31: GLOBAL HYDROGEL MARKET, BY PRODUCT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 32: GLOBAL SEMI-CRYSTALLINE BUTTONS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 33: GLOBAL SEMI-CRYSTALLINE BUTTONS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 34: GLOBAL AMORPHOUS GELS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 35: GLOBAL AMORPHOUS GELS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 36: GLOBAL IMPREGNATED GAUZE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 37: GLOBAL IMPREGNATED GAUZE MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 38: GLOBAL FILMS & MATRICES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 39: GLOBAL FILMS & MATRICES MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 40: GLOBAL HYDROGEL SHEETS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 41: GLOBAL HYDROGEL SHEETS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 42: GLOBAL HYDROGEL MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 43: GLOBAL HYDROGEL MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 44: GLOBAL CONTACT LENSES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 45: GLOBAL CONTACT LENSES MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 46: GLOBAL HYGIENE PRODUCTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 47: GLOBAL HYGIENE PRODUCTS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 48: GLOBAL WOUND CARE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 49: GLOBAL WOUND CARE MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 50: GLOBAL DRUG DELIVERY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 51: GLOBAL DRUG DELIVERY MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 52: GLOBAL TISSUE ENGINEERING MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 53: GLOBAL TISSUE ENGINEERING MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 54: GLOBAL OTHERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 55: GLOBAL OTHERS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 56: GLOBAL HYDROGEL MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 57: GLOBAL HYDROGEL MARKET, BY GEOGRAPHY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 58: NORTH AMERICA HYDROGEL MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 59: NORTH AMERICA HYDROGEL MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 60: EUROPE HYDROGEL MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 61: EUROPE HYDROGEL MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 62: ASIA PACIFIC HYDROGEL MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 63: ASIA PACIFIC HYDROGEL MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 64: REST OF WORLD HYDROGEL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 65: REST OF WORLD HYDROGEL MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

FIGURE LIST

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: GLOBAL HYDROGEL MARKET, GROWTH POTENTIAL, BY FORM, IN 2019

FIGURE 6: GLOBAL HYDROGEL MARKET, BY AMORPHOUS HYDROGELS, 2019-2028 (IN $ MILLION)

FIGURE 7: GLOBAL HYDROGEL MARKET, BY SEMI-CRYSTALLINE HYDROGELS, 2019-2028 (IN $ MILLION)

FIGURE 8: GLOBAL HYDROGEL MARKET, BY CRYSTALLINE HYDROGELS, 2019-2028 (IN $ MILLION)

FIGURE 9: GLOBAL HYDROGEL MARKET, GROWTH POTENTIAL, BY RAW MATERIALS, IN 2019

FIGURE 10: GLOBAL HYDROGEL MARKET, BY SYNTHETIC, 2019-2028 (IN $ MILLION)

FIGURE 11: GLOBAL HYDROGEL MARKET, BY NATURAL, 2019-2028 (IN $ MILLION)

FIGURE 12: GLOBAL HYDROGEL MARKET, BY HYBRID HYDROGELS, 2019-2028 (IN $ MILLION)

FIGURE 13: GLOBAL HYDROGEL MARKET, GROWTH POTENTIAL, BY COMPOSITION, IN 2019

FIGURE 14: GLOBAL HYDROGEL MARKET, BY POLYACRYLATE, 2019-2028 (IN $ MILLION)

FIGURE 15: GLOBAL HYDROGEL MARKET, BY POLYACRYLAMIDE, 2019-2028 (IN $ MILLION)

FIGURE 16: GLOBAL HYDROGEL MARKET, BY SILICONE-MODIFIED HYDROGELS, 2019-2028 (IN $ MILLION)

FIGURE 17: GLOBAL HYDROGEL MARKET, BY AGAR-BASED, 2019-2028 (IN $ MILLION)

FIGURE 18: GLOBAL HYDROGEL MARKET, BY OTHERS, 2019-2028 (IN $ MILLION)

FIGURE 19: GLOBAL HYDROGEL MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2019

FIGURE 20: GLOBAL HYDROGEL MARKET, BY SEMI-CRYSTALLINE BUTTONS, 2019-2028 (IN $ MILLION)

FIGURE 21: GLOBAL HYDROGEL MARKET, BY AMORPHOUS GELS, 2019-2028 (IN $ MILLION)

FIGURE 22: GLOBAL HYDROGEL MARKET, BY IMPREGNATED GAUZE, 2019-2028 (IN $ MILLION)

FIGURE 23: GLOBAL HYDROGEL MARKET, BY FILMS & MATRICES, 2019-2028 (IN $ MILLION)

FIGURE 24: GLOBAL HYDROGEL MARKET, BY HYDROGEL SHEETS, 2019-2028 (IN $ MILLION)

FIGURE 25: GLOBAL HYDROGEL MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 26: GLOBAL HYDROGEL MARKET, BY CONTACT LENSES, 2019-2028 (IN $ MILLION)

FIGURE 27: GLOBAL HYDROGEL MARKET, BY HYGIENE PRODUCTS, 2019-2028 (IN $ MILLION)

FIGURE 28: GLOBAL HYDROGEL MARKET, BY WOUND CARE, 2019-2028 (IN $ MILLION)

FIGURE 29: GLOBAL HYDROGEL MARKET, BY DRUG DELIVERY, 2019-2028 (IN $ MILLION)

FIGURE 30: GLOBAL HYDROGEL MARKET, BY TISSUE ENGINEERING, 2019-2028 (IN $ MILLION)

FIGURE 31: GLOBAL HYDROGEL MARKET, BY OTHERS, 2019-2028 (IN $ MILLION)

FIGURE 32: NORTH AMERICA HYDROGEL MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 33: UNITED STATES HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: CANADA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: EUROPE HYDROGEL MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 36: UNITED KINGDOM HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 37: GERMANY HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 38: FRANCE HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 39: ITALY HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 40: RUSSIA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 41: BELGIUM HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 42: POLAND HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 43: REST OF EUROPE HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 44: ASIA PACIFIC HYDROGEL MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 45: CHINA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 46: JAPAN HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 47: INDIA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 48: SOUTH KOREA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 49: INDONESIA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 50: THAILAND HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 51: VIETNAM HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 52: AUSTRALIA & NEW ZEALAND HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 53: REST OF ASIA PACIFIC HYDROGEL MARKET, 2019-2028 (IN $ MILLION

FIGURE 54: REST OF WORLD HYDROGEL MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 55: LATIN AMERICA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

FIGURE 56: MIDDLE EAST & AFRICA HYDROGEL MARKET, 2019-2028 (IN $ MILLION)

- MARKET BY FORM

- AMORPHOUS HYDROGELS

- SEMI-CRYSTALLINE HYDROGELS

- CRYSTALLINE HYDROGELS

- MARKET BY RAW MATERIALS

- SYNTHETIC

- NATURAL

- HYBRID HYDROGELS

- MARKET BY COMPOSITION

- POLYACRYLATE

- POLYACRYLAMIDE

- SILICONE-MODIFIED HYDROGELS

- AGAR-BASED

- OTHERS

- MARKET BY PRODUCT

- SEMI-CRYSTALLINE BUTTONS

- AMORPHOUS GELS

- IMPREGNATED GAUZE

- FILMS & MATRICES

- HYDROGEL SHEETS

- MARKET BY END-USER

- CONTACT LENSES

- HYGIENE PRODUCTS

- WOUND CARE

- DRUG DELIVERY

- TISSUE ENGINEERING

- OTHERS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.