GLOBAL WHEY PROTEIN INGREDIENTS MARKET FORECAST 2021-2028

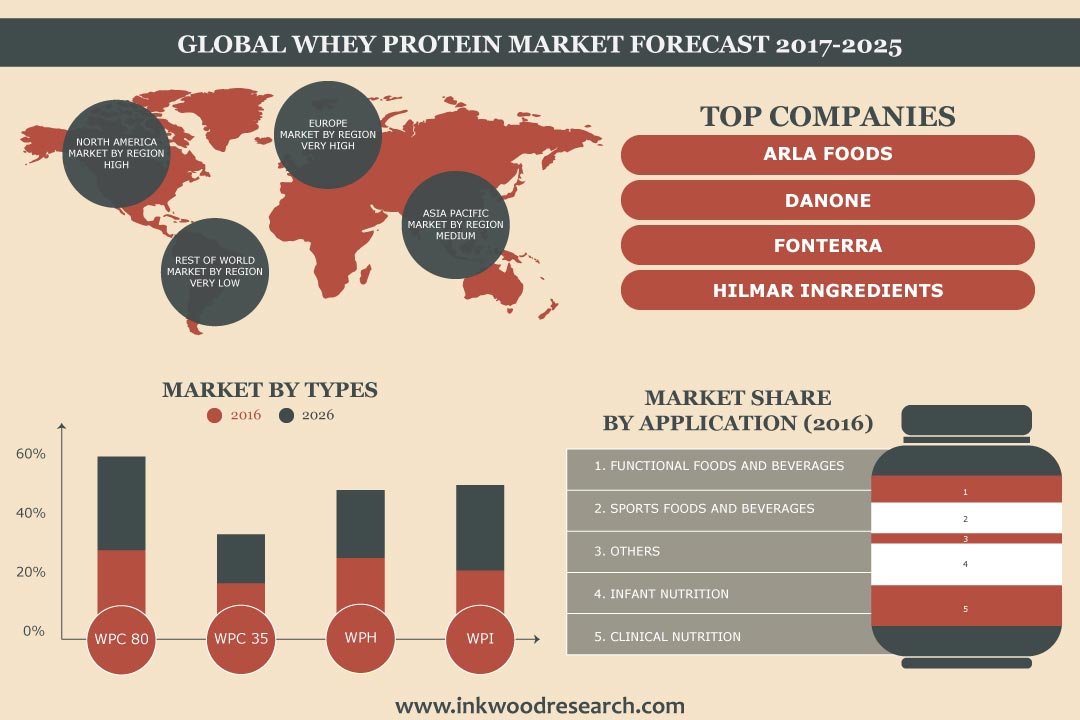

Global Whey Protein Ingredients Market by Type (WPI, WPC 80, WPC 50-79, WPC 35, DWP) Market by End-user (Bakery and Confectionery, Dairy Products, Frozen Foods, Sports Nutrition, Beverages, Meat Products, Medicine, Other End-users) Market by Application (Functional Foods and Beverages, Infant Nutrition, Sports Foods and Beverages, Clinical Nutrition, Other Applications) by Geography

Inkwood Research anticipates that the global whey protein ingredients market will reach $18.01 billion by 2028, growing at a CAGR of 11.22% during the forecast period. In terms of volume, the market size is estimated to reach 1.60 kilotons growing with a CAGR of 5.49%.

Whey protein is a by-product formed during the manufacturing of cheese. This product is rich in protein. Hence, it is used for increasing protein intake in the diet, especially by bodybuilders.

To know more about this report, request a free sample copy.

Key enablers of the global whey protein ingredients market growth are:

- Increasing awareness about the benefits of whey protein

- Thriving health & wellness products

- Increased demand for high-quality protein supplements

- Rising health-conscious consumers

- Health-conscious consumers have significantly led to increasing demand for whey protein in the past few years.

- The growing obesity in the young population, especially in America and China, has led to a rising preference for whey-derived products as part of their protein intakes.

- Moreover, advertisements and gym/fitness trainers have considerably increased the awareness about whey proteins among the consumers.

Key factors restraining market growth:

- Raw material price fluctuations and high prices

- Milk is the main raw material for the whey protein ingredient industry. Historically, milk prices have shown high fluctuation rates. This makes it difficult for a cheese/whey protein manufacturer to make consistent profits unless vertically integrated.

- Further, whey protein as a protein source is expensive compared to other alternatives such as soy and egg proteins.

- Fragmented nature of the industry

- Incidences of farm animal diseases reduce farm products’ adoption

- Health-related problems from whey protein use

The report scope of the global whey protein ingredients market covers the segmentation analysis of type, end-user, and application.

Market by End-User:

- Bakery & Confectionery

- Bakery & Confectionery is the major end-user in the market as of 2020, both in terms of revenue and volume.

- Due to its easily adaptable and cost-efficient aspects, whey proteins are used as multi-functional food ingredients in the production process of bakery & confectionery products

- Moreover, the industry uses modified whey products such as sweet whey, whey protein concentrates (WPC), whey protein isolates (WPI), and lactose derivatives, which act as functional ingredients.

- For instance, whey protein-based ingredients are used as milk solids sources in the formulation of milk chocolate flavored coatings for ice cream, candy bars, and other enrobing applications.

- Dairy Products

- Frozen Foods

- Sports Nutrition

- Beverages

- Meat Products

- Medicine

- Others

Geographically, the global whey protein ingredients market has been segmented on the basis of four major regions, which includes:

- North America: The United States and Canada

- North America is the largest market for whey protein ingredients in terms of revenue and volume, with the growing fitness industry.

- Further, the increased awareness about health amongst the consumers is expected to drive the market growth in the region.

- Europe: The United Kingdom, Germany, France, Italy, Russia, Belgium, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia-Pacific

- Rest of World: Latin America, Middle East & Africa

The major players in the global whey protein ingredients market are:

- Danone SA

- Arla Foods

- Fonterra Co-Operative Group Limited

- Omega Protein

- Erie Foods International Inc

- Grande Custom Ingredients

Key strategies adopted by some of these companies:

In March 2021, the MEGGLE Group GmbH acquired Stegmann Emmentaler Käsereien GmbH to strengthen its cheese product segment. In June 2021, Arla built a dairy farm in Nigeria to support local milk production. In July 2021, Saputo Inc. entered into an agreement to acquire the activities of Wensleydale Dairy Products Limited.

Key findings of the global whey protein ingredients market:

- The thriving packaged and specialty food industries are beneficial for market growth.

- The rising usage of whey proteins in sports nutrition & personal care products offers growth opportunities.

- There are increasing applications of whey proteins in infant nutrition products.

- Whey proteins are increasingly used in functional foods.

- The rising promotional activities by companies contribute to market growth.

Frequently Asked Questions (FAQs):

- Which country leads the market for whey protein ingredients?

A: The United States leads the market for whey protein ingredients.

- Which whey protein ingredient type is expected to show the fastest growth?

A: WPC 80 is expected to show the fastest growth in terms of revenue and volume.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- INCREASING AWARENESS ABOUT THE BENEFITS OF WHEY PROTEIN

- GROWING HEALTH & WELLNESS PRODUCTS

- INCREASED DEMAND FOR HIGH-QUALITY PROTEIN SUPPLEMENTS

- RISING HEALTH-CONSCIOUS CONSUMERS

- KEY RESTRAINTS

- RAW MATERIAL PRICE FLUCTUATIONS AND HIGH PRICES

- FRAGMENTED NATURE OF THE INDUSTRY

- INCIDENCES OF FARM ANIMAL DISEASES REDUCE FARM PRODUCTS’ ADOPTION

- HEALTH-RELATED PROBLEMS FROM WHEY PROTEIN USE

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON WHEY PROTEIN INGREDIENTS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- VALUE CHAIN ANALYSIS

- DAIRY/CHEESE INDUSTRY

- FOOD AND BEVERAGE INDUSTRY

- VALUE-ADDED PRODUCT

- BIOETHANOL FUEL PRODUCTION

- MARKET BY TYPE (VALUE: $ MILLION & VOLUME: KILOTONS)

- WPI

- WPC 80

- WPC 50-79

- WPC 35

- DWP

- MARKET BY END-USER (VALUE: $ MILLION & VOLUME: KILOTONS)

- BAKERY AND CONFECTIONERY

- DAIRY PRODUCTS

- FROZEN FOODS

- SPORTS NUTRITION

- BEVERAGES

- MEAT PRODUCTS

- MEDICINE

- OTHER END-USERS

- MARKET BY APPLICATION (VALUE: $ MILLION & VOLUME: KILOTONS)

- FUNCTIONAL FOODS AND BEVERAGES

- INFANT NUTRITION

- SPORTS FOODS AND BEVERAGES

- CLINICAL NUTRITION

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS (VALUE: $ MILLION & VOLUME: KILOTONS)

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- AGROPUR MSI LLC

- ALPAVIT

- AMERICAN DAIRY PRODUCTS INSTITUTE

- ARLA FOODS

- DANONE SA

- ERIE FOODS INTERNATIONAL INC

- FONTERRA CO-OPERATIVE GROUP

- GLANBIA PLC

- GRANDE CUSTOM INGREDIENTS

- LEPRINO FOODS COMPANY

- MEGGLE GROUP

- MILK SPECIALTIES

- OMEGA PROTEIN

- SAPUTO INGREDIENTS

- WESTLAND MILK PRODUCTS

- KEY STRATEGIC DEVELOPMENTS

TABLE LIST

TABLE 1: MARKET SNAPSHOT – WHEY PROTEIN INGREDIENTS

TABLE 2: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 3: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 4: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY TYPE, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 5: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY TYPE, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 6: GLOBAL WPI MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 7: GLOBAL WPI MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 8: GLOBAL WPC 80 MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 9: GLOBAL WPC 80 MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 10: GLOBAL WPC 50-79 MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 11: GLOBAL WPC 50-79 MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 12: GLOBAL WPC 35 MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 13: GLOBAL WPC 35 MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 14: GLOBAL DWP MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 15: GLOBAL DWP MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 16: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 17: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY END-USER, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 18: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 19: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY END-USER, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 20: GLOBAL BAKERY AND CONFECTIONERY MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 21: GLOBAL BAKERY AND CONFECTIONERY MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 22: GLOBAL DAIRY PRODUCTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 23: GLOBAL DAIRY PRODUCTS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 24: GLOBAL FROZEN FOODS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 25: GLOBAL FROZEN FOODS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 26: GLOBAL SPORTS NUTRITION MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 27: GLOBAL SPORTS NUTRITION MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 28: GLOBAL BEVERAGES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 29: GLOBAL BEVERAGES MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 30: GLOBAL MEAT PRODUCTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 31: GLOBAL MEAT PRODUCTS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 32: GLOBAL MEDICINE MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 33: GLOBAL MEDICINE MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 34: GLOBAL OTHER END-USERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 35: GLOBAL OTHER END-USERS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 36: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 37: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 38: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 39: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY APPLICATION, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 40: GLOBAL FUNCTIONAL FOODS AND BEVERAGES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 41: GLOBAL FUNCTIONAL FOODS AND BEVERAGES MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 42: GLOBAL INFANT NUTRITION MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 43: GLOBAL INFANT NUTRITION MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 44: GLOBAL SPORTS FOODS AND BEVERAGES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 45: GLOBAL SPORTS FOODS AND BEVERAGES MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 46: GLOBAL CLINICAL NUTRITION MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 47: GLOBAL CLINICAL NUTRITION MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 48: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 49: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 50: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 51: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 52: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 53: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 54: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 55: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 56: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 57: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 58: EUROPE WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 59: EUROPE WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 60: EUROPE WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 61: EUROPE WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 62: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 63: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 64: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 65: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 66: REST OF WORLD WHEY PROTEIN INGREDIENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 67: REST OF WORLD WHEY PROTEIN INGREDIENTS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 68: REST OF WORLD WHEY PROTEIN INGREDIENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN KILOTONS)

TABLE 69: REST OF WORLD WHEY PROTEIN INGREDIENTS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN KILOTONS)

TABLE 70: LIST OF MERGERS & ACQUISITIONS

TABLE 71: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 72: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

FIGURE LIST

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: VALUE CHAIN ANALYSIS

FIGURE 6: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, GROWTH POTENTIAL, BY TYPE, IN 2020

FIGURE 7: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY WPI, 2021-2028 (IN $ MILLION)

FIGURE 8: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY WPC 80, 2021-2028 (IN $ MILLION)

FIGURE 9: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY WPC 50-79, 2021-2028 (IN $ MILLION)

FIGURE 10: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY WPC 35, 2021-2028 (IN $ MILLION)

FIGURE 11: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY DWP, 2021-2028 (IN $ MILLION)

FIGURE 12: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2020

FIGURE 13: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY BAKERY AND CONFECTIONERY, 2021-2028 (IN $ MILLION)

FIGURE 14: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY DAIRY PRODUCTS, 2021-2028 (IN $ MILLION)

FIGURE 15: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY FROZEN FOODS, 2021-2028 (IN $ MILLION)

FIGURE 16: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY SPORTS NUTRITION, 2021-2028 (IN $ MILLION)

FIGURE 17: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY BEVERAGES, 2021-2028 (IN $ MILLION)

FIGURE 18: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY MEAT PRODUCTS, 2021-2028 (IN $ MILLION)

FIGURE 19: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY MEDICINE, 2021-2028 (IN $ MILLION)

FIGURE 20: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY OTHER END-USERS, 2021-2028 (IN $ MILLION)

FIGURE 21: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2020

FIGURE 22: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY FUNCTIONAL FOODS AND BEVERAGES, 2021-2028 (IN $ MILLION)

FIGURE 23: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY INFANT NUTRITION, 2021-2028 (IN $ MILLION)

FIGURE 24: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY SPORTS FOODS AND BEVERAGES, 2021-2028 (IN $ MILLION)

FIGURE 25: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY CLINICAL NUTRITION, 2021-2028 (IN $ MILLION)

FIGURE 26: GLOBAL WHEY PROTEIN INGREDIENTS MARKET, BY OTHER APPLICATIONS, 2021-2028 (IN $ MILLION)

FIGURE 27: NORTH AMERICA WHEY PROTEIN INGREDIENTS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 28: UNITED STATES WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 29: CANADA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 30: EUROPE WHEY PROTEIN INGREDIENTS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 31: UNITED KINGDOM WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 32: GERMANY WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 33: FRANCE WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 34: ITALY WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 35: RUSSIA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 36: BELGIUM WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 37: POLAND WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 38: REST OF EUROPE WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 39: ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 40: CHINA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 41: JAPAN WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 42: INDIA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 43: SOUTH KOREA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 44: INDONESIA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 45: THAILAND WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 46: VIETNAM WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 47: AUSTRALIA & NEW ZEALAND WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 48: REST OF ASIA-PACIFIC WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 49: REST OF WORLD WHEY PROTEIN INGREDIENTS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 50: LATIN AMERICA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 51: MIDDLE EAST & AFRICA WHEY PROTEIN INGREDIENTS MARKET, 2021-2028 (IN $ MILLION)

- MARKET BY TYPE (VALUE: $ MILLION & VOLUME: KILOTONS)

- WPI

- WPC 80

- WPC 50-79

- WPC 35

- DWP

- MARKET BY END-USER (VALUE: $ MILLION & VOLUME: KILOTONS)

- BAKERY AND CONFECTIONERY

- DAIRY PRODUCTS

- FROZEN FOODS

- SPORTS NUTRITION

- BEVERAGES

- MEAT PRODUCTS

- MEDICINE

- OTHER END-USERS

- MARKET BY APPLICATION (VALUE: $ MILLION & VOLUME: KILOTONS)

- FUNCTIONAL FOODS AND BEVERAGES

- INFANT NUTRITION

- SPORTS FOODS AND BEVERAGES

- CLINICAL NUTRITION

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS (VALUE: $ MILLION & VOLUME: KILOTONS)

- NORTH AMERICA

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.