GLOBAL DIETARY SUPPLEMENTS MARKET FORECAST 2019-2028

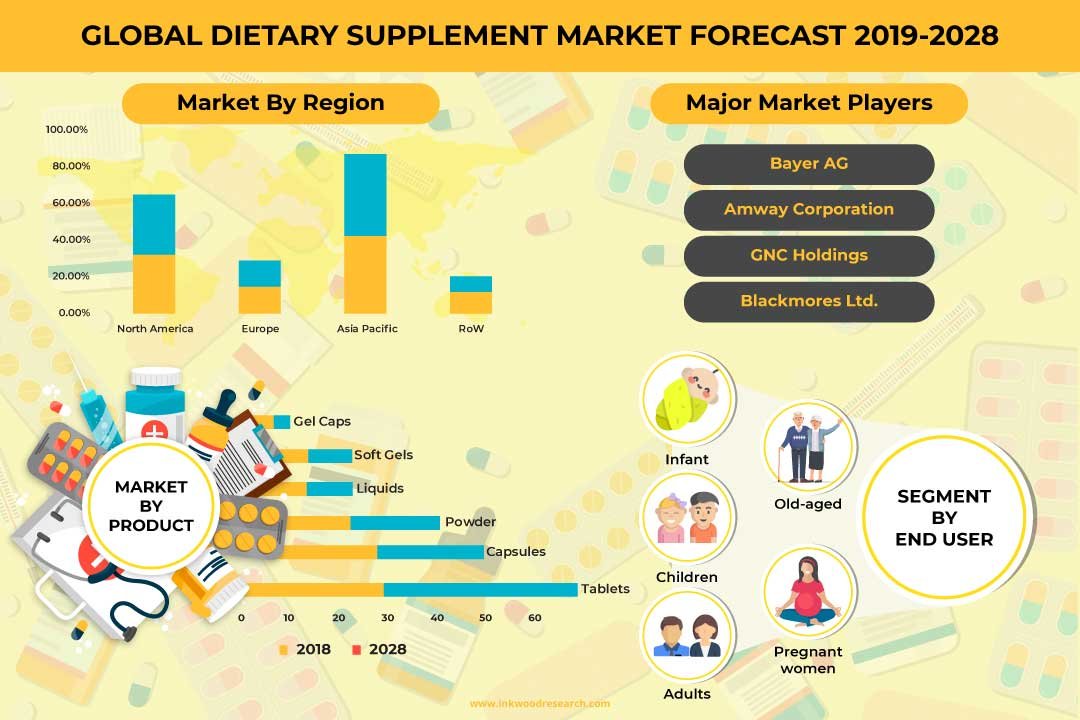

Global Dietary Supplements Market by Ingredients (Botanicals, Vitamins, Minerals, Amino Acids, Enzymes, Other Ingredients) by Product (Tablets, Capsules, Powder, Liquids, Soft Gels, Gel Caps) by Application (Additional Supplement, Medicinal Supplement, Sports Nutrition) by End-user (Infant, Children, Adults, Pregnant Women, Old-aged) and by Geography

Inkwood Research estimates that the global dietary supplements market will grow with an anticipated CAGR of 9.26% during the forecast period, reaching a revenue of $330.6 billion by 2028.

Dietary supplements are products beneficial in supplementing the diet, in the form of tablets, powder, and liquid. The supplements assist in providing nutrients like vitamins, minerals, amino acids, and fiber. The health & wellness segment will play a critical role in promoting the usage of dietary supplements over the forecast period.

To know more about this report, request a free sample report.

Key factors driving the global dietary supplements market growth are:

- Increasing demand for supplements in the health and wellness industry

- The rising health awareness among all ages on a global level is likely to play a crucial role in increasing the number of gymnasiums and fitness centers.

- Furthermore, leading corporates, including ExxonMobil, IBM, Microsoft, AT&T, BASF, and GSK, have increased their spending for the expansion of gymnasiums and fitness centers in their commercial offices.

- Encouraging outlook towards sports nutrition

- Budding interest in medical nutrition

- Rise in prevalence of active living

- Growing demand for nutraceutical products in the e-commerce domain

Key market growth restraints:

- Easy availability of counterfeit products

- Regulatory concerns

- A major hurdle for the growth of the market studied is its undefined scope and regulatory inefficiencies. There is no global consensus on the universal definition of different types of supplements.

- For instance, a product considered to be a dietary supplement and regulated as a food in the United States, maybe treated as complementary or prescription medicine in another jurisdiction.

- Rising demand for functional foods

- Negative publicity

The report scope of the global dietary supplements market covers the segmentation analysis of product, ingredient, application, and end-user.

Market by Product:

- Tablets

- Capsules

- Powder

- Powders are the fastest-growing product in the global dietary supplements market.

- Powders are usually flavored & colored, and can be dissolved in any beverage of the consumer’s choice.

- The increasing consumption of supplements for muscle building and maintaining wellbeing are some of the major aspects contributing to the growth of this segment.

- Liquids

- Soft Gels

- Gel Caps

Geographically, the global dietary supplements market has been segmented on the basis of four major regions, which includes:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Russia, Belgium, Poland, and Rest of Europe

- Asia Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia Pacific

- The Asia Pacific region is projected to dominate the global market by 2028.

- The Asia Pacific dietary supplements market has witnessed rapid growth in both developed and developing countries. Demand for supplements in countries like India, China, and Japan has increased in recent years, owing to the aging population’s considerable presence in such developing countries.

- Furthermore, Omni Active Health Technology, an Indian company, recently received an investment amounting to $35 million from Everstone Group. These partnerships between old and new players are likely to strengthen market growth in the country.

- Rest of World: Latin America, the Middle East & Africa

The major players in the global dietary supplements market are:

- Bayer AG

- Glanbia PLC

- Pfizer

- Others

Key strategies adopted by some of these companies:

In October 2018, Glanbia Plc signed an agreement to acquire Slimfast. Slimfast is an eminent weight management and health & wellness brand family in the food, drug, mass, and club (FDMC) channel in the US and UK.

Key findings of the global dietary supplements market:

- The growing demand for medical nutrition is driving the market.

- Sports nutrition is a prominent application in the global dietary supplements market.

- Vitamins are the fastest-growing and dominant ingredient in the global dietary supplements market.

Frequently Asked Questions & Answers (FAQs):

- Which application is anticipated to dominate the dietary supplements market?

A: Additional supplement is anticipated to dominate the dietary supplements market.

- Which region offers lucrative growth opportunities for dietary supplements?

A: The Asia Pacific offers lucrative growth opportunities for dietary supplements.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- INCREASING DEMAND FOR SUPPLEMENTS IN HEALTH AND WELLNESS INDUSTRY

- ENCOURAGING OUTLOOK TOWARDS SPORTS NUTRITION

- BUDDING INTEREST IN MEDICAL NUTRITION

- RISE IN PREVALENCE OF ACTIVE LIVING

- GROWING DEMAND FOR NUTRACEUTICAL PRODUCTS IN THE E-COMMERCE DOMAIN

- RISING INTEREST IN PLANT-BASED SUPPLEMENTS

- KEY RESTRAINTS

- EASY AVAILABILITY OF COUNTERFEIT PRODUCTS

- REGULATORY CONCERNS IMPACTING THE MARKET GROWTH

- RISING DEMAND FOR FUNCTIONAL FOODS

- NEGATIVE PUBLICITY AFFECTING THE OVERALL MARKET

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- IMPACT OF COVID-19 ON DIETARY SUPPLEMENTS MARKET

- KEY BUYING CRITERIA

- COMPANY BACKGROUND AND EXPERIENCE

- COST

- EASE OF USE

- MARKET BY INGREDIENTS

- BOTANICALS

- VITAMINS

- MINERALS

- AMINO ACIDS

- ENZYMES

- OTHER INGREDIENTS

- MARKET BY PRODUCT

- TABLETS

- CAPSULES

- POWDER

- LIQUIDS

- SOFT GELS

- GEL CAPS

- MARKET BY APPLICATION

- ADDITIONAL SUPPLEMENT

- MEDICINAL SUPPLEMENT

- SPORTS NUTRITION

- MARKET BY END-USER

- INFANT

- CHILDREN

- ADULTS

- PREGNANT WOMEN

- OLD-AGED

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILE

- ABBOTT LABORATORIES

- BAYER AG

- GLANBIA PLC

- GLAXOSMITHKLINE PLC

- HERBALIFE LTD

- MERCK KGAA

- OTSUKA HOLDINGS CO LTD

- PFIZER

- RECKITT BENCKISER GROUP PLC

- SANOFI SA

- SUNTORY HOLDINGS LTD

- NATURE’S BOUNTY

- AMWAY CORPORATION

- GNC HOLDINGS

- BLACKMORES LTD

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – DIETARY SUPPLEMENTS

TABLE 2: GLOBAL DIETARY SUPPLEMENTS MARKET, BY INGREDIENTS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: GLOBAL DIETARY SUPPLEMENTS MARKET, BY INGREDIENTS, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: GLOBAL BOTANICALS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: GLOBAL BOTANICALS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: GLOBAL VITAMINS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: GLOBAL VITAMINS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: GLOBAL MINERALS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: GLOBAL MINERALS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 10: GLOBAL AMINO ACIDS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: GLOBAL AMINO ACIDS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 12: GLOBAL ENZYMES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: GLOBAL ENZYMES MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 14: GLOBAL OTHER INGREDIENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: GLOBAL OTHER INGREDIENTS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 16: GLOBAL DIETARY SUPPLEMENTS MARKET, BY PRODUCT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: GLOBAL DIETARY SUPPLEMENTS MARKET, BY PRODUCT, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 18: GLOBAL TABLETS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: GLOBAL TABLETS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 20: GLOBAL CAPSULES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: GLOBAL CAPSULES MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 22: GLOBAL POWDER MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: GLOBAL POWDER MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 24: GLOBAL LIQUIDS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 25: GLOBAL LIQUIDS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 26: GLOBAL SOFT GELS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 27: GLOBAL SOFT GELS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 28: GLOBAL GEL CAPS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 29: GLOBAL GEL CAPS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 30: GLOBAL DIETARY SUPPLEMENTS MARKET, BY APPLICATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 31: GLOBAL DIETARY SUPPLEMENTS MARKET, BY APPLICATION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 32: GLOBAL ADDITIONAL SUPPLEMENT MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 33: GLOBAL ADDITIONAL SUPPLEMENT MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 34: GLOBAL MEDICINAL SUPPLEMENT MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 35: GLOBAL MEDICINAL SUPPLEMENT MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 36: GLOBAL SPORTS NUTRITION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 37: GLOBAL SPORTS NUTRITION MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 38: GLOBAL DIETARY SUPPLEMENTS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 39: GLOBAL DIETARY SUPPLEMENTS MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 40: GLOBAL INFANT MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 41: GLOBAL INFANT MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 42: GLOBAL CHILDREN MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 43: GLOBAL CHILDREN MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 44: GLOBAL ADULTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 45: GLOBAL ADULTS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 46: GLOBAL PREGNANT WOMEN MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 47: GLOBAL PREGNANT WOMEN MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 48: GLOBAL OLD-AGED MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 49: GLOBAL OLD-AGED MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 50: GLOBAL DIETARY SUPPLEMENTS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 51: GLOBAL DIETARY SUPPLEMENTS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 52: NORTH AMERICA DIETARY SUPPLEMENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 53: NORTH AMERICA DIETARY SUPPLEMENTS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 54: EUROPE DIETARY SUPPLEMENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 55: EUROPE DIETARY SUPPLEMENTS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 56: ASIA PACIFIC DIETARY SUPPLEMENTS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 57: ASIA PACIFIC DIETARY SUPPLEMENTS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 58: REST OF WORLD DIETARY SUPPLEMENTS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 59: REST OF WORLD DIETARY SUPPLEMENTS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1: KEY INVESTMENT INSIGHTS

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: KEY BUYING IMPACT ANALYSIS

FIGURE 6: GLOBAL DIETARY SUPPLEMENTS MARKET, GROWTH POTENTIAL, BY INGREDIENTS, IN 2019

FIGURE 7: GLOBAL DIETARY SUPPLEMENTS MARKET, BY BOTANICALS, 2019-2028 (IN $ MILLION)

FIGURE 8: GLOBAL DIETARY SUPPLEMENTS MARKET, BY VITAMINS, 2019-2028 (IN $ MILLION)

FIGURE 9: GLOBAL DIETARY SUPPLEMENTS MARKET, BY MINERALS, 2019-2028 (IN $ MILLION)

FIGURE 10: GLOBAL DIETARY SUPPLEMENTS MARKET, BY AMINO ACIDS, 2019-2028 (IN $ MILLION)

FIGURE 11: GLOBAL DIETARY SUPPLEMENTS MARKET, BY ENZYMES, 2019-2028 (IN $ MILLION)

FIGURE 12: GLOBAL DIETARY SUPPLEMENTS MARKET, BY OTHER INGREDIENTS, 2019-2028 (IN $ MILLION)

FIGURE 13: GLOBAL DIETARY SUPPLEMENTS MARKET, GROWTH POTENTIAL, BY PRODUCT, IN 2019

FIGURE 14: GLOBAL DIETARY SUPPLEMENTS MARKET, BY TABLETS, 2019-2028 (IN $ MILLION)

FIGURE 15: GLOBAL DIETARY SUPPLEMENTS MARKET, BY CAPSULES, 2019-2028 (IN $ MILLION)

FIGURE 16: GLOBAL DIETARY SUPPLEMENTS MARKET, BY POWDER, 2019-2028 (IN $ MILLION)

FIGURE 17: GLOBAL DIETARY SUPPLEMENTS MARKET, BY LIQUIDS, 2019-2028 (IN $ MILLION)

FIGURE 18: GLOBAL DIETARY SUPPLEMENTS MARKET, BY SOFT GELS, 2019-2028 (IN $ MILLION)

FIGURE 19: GLOBAL DIETARY SUPPLEMENTS MARKET, BY GEL CAPS, 2019-2028 (IN $ MILLION)

FIGURE 20: GLOBAL DIETARY SUPPLEMENTS MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2019

FIGURE 21: GLOBAL DIETARY SUPPLEMENTS MARKET, BY ADDITIONAL SUPPLEMENT, 2019-2028 (IN $ MILLION)

FIGURE 22: GLOBAL DIETARY SUPPLEMENTS MARKET, BY MEDICINAL SUPPLEMENT, 2019-2028 (IN $ MILLION)

FIGURE 23: GLOBAL DIETARY SUPPLEMENTS MARKET, BY SPORTS NUTRITION, 2019-2028 (IN $ MILLION)

FIGURE 24: GLOBAL DIETARY SUPPLEMENTS MARKET, GROWTH POTENTIAL, BY END-USER, IN 2019

FIGURE 25: GLOBAL DIETARY SUPPLEMENTS MARKET, BY INFANT, 2019-2028 (IN $ MILLION)

FIGURE 26: GLOBAL DIETARY SUPPLEMENTS MARKET, BY CHILDREN, 2019-2028 (IN $ MILLION)

FIGURE 27: GLOBAL DIETARY SUPPLEMENTS MARKET, BY ADULTS, 2019-2028 (IN $ MILLION)

FIGURE 28: GLOBAL DIETARY SUPPLEMENTS MARKET, BY PREGNANT WOMEN, 2019-2028 (IN $ MILLION)

FIGURE 29: GLOBAL DIETARY SUPPLEMENTS MARKET, BY OLD-AGED, 2019-2028 (IN $ MILLION)

FIGURE 30: NORTH AMERICA DIETARY SUPPLEMENTS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 31: UNITED STATES DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 32: CANADA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 33: EUROPE DIETARY SUPPLEMENTS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 34: UNITED KINGDOM DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: GERMANY DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 36: FRANCE DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 37: ITALY DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 38: RUSSIA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 39: BELGIUM DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 40: POLAND DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 41: REST OF EUROPE DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 42: ASIA PACIFIC DIETARY SUPPLEMENTS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 43: CHINA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 44: JAPAN DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 45: INDIA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 46: SOUTH KOREA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 47: INDONESIA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 48: THAILAND DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 49: VIETNAM DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 50: AUSTRALIA & NEW ZEALAND DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 51: REST OF ASIA PACIFIC DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 52: REST OF WORLD DIETARY SUPPLEMENTS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 53: LATIN AMERICA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 54: MIDDLE EAST & AFRICA DIETARY SUPPLEMENTS MARKET, 2019-2028 (IN $ MILLION)

- MARKET BY INGREDIENTS

- BOTANICALS

- VITAMINS

- MINERALS

- AMINO ACIDS

- ENZYMES

- OTHER INGREDIENTS

- MARKET BY PRODUCT

- TABLETS

- CAPSULES

- POWDER

- LIQUIDS

- SOFT GELS

- GEL CAPS

- MARKET BY APPLICATION

- ADDITIONAL SUPPLEMENT

- MEDICINAL SUPPLEMENT

- SPORTS NUTRITION

- MARKET BY END-USER

- INFANT

- CHILDREN

- ADULTS

- PREGNANT WOMEN

- OLD-AGED

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.