GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET FORECAST 2019-2027

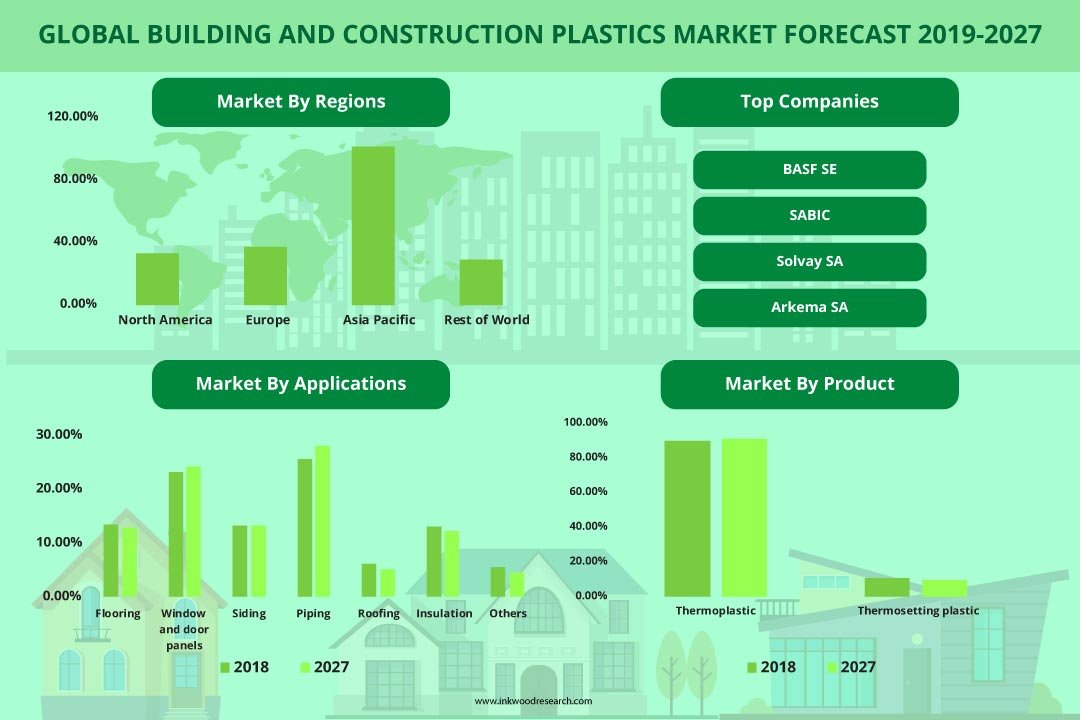

Global Building and Construction Plastics Market by Product Type (Thermoplastic, Thermosetting Plastic) by Application (Flooring, Window and Door Panels, Siding, Piping, Roofing, Insulation, Others) by Geography.

The global market of building and construction plastics created $XX million of revenue in 2018 and is anticipated to amount to $115.37 million by 2027, while evolving at 6.67% of CAGR between the projected years of 2019 and 2027.

The global building and construction plastics market is driven by various factors, as mentioned below:

- The surge in the piping industry

- Growing demand for plastic products

- Increased usage of recycled plastics in construction

- The surge in construction activities

To know more about this report, request a free sample copy.

The increasing demand for construction activities is a major factor that is driving the growth of the building and construction plastics market. The dire need for replacing debilitated structures is a major concern worldwide. Rising investments in public and private sectors, coupled with the growing population, are driving the demand for construction activities. The usage of construction plastics provides durability, weather resistance, and reduction in overall weight. Many economies like India, Vietnam, etc. are highly dependent on plastic products, and this reliance is further fueling the demand for building and construction plastics.

The thermoplastic segment is the largest, as well as the fastest-growing segment in building and construction plastic with around 89.7% market share in 2018. Thermoplastic is a kind of plastic that is pliable at a certain elevated temperature and solidifies upon cooling. The polymer chain is linked by intermolecular forces, which weaken by the increasing temperatures and yielding a sticky residue. The thermoplastic segment is majorly driven by the extensive use of thermoplastics in a variety of applications in the construction sector, like flooring, piping, windows, and panels, etc. The ability of thermoplastics to be reshaped is increasing the demand for thermoplastics in the region. The need for eco-friendly and recyclable plastic is another factor that is fueling the uptake of thermoplastics.

Globally, the ever-increasing use of plastics and dependency are escalating the growth of the market. However, the rising concern over plastic waste on a global scale is limiting the market growth in the upcoming years. China and Malaysia have banned imports of plastic waste from reducing the effect of plastic pollution. Non-biodegradable nature of plastic coupled with strict regulations levied by the administration, is challenging the growth of the market. Although, the use of bioplastics and recycled plastic will upsurge the demand for building and construction plastics market.

Report scope of the global building and construction plastics market covers segmentation analysis of type, application, and geography.

Market by Type:

- Thermoplastic

- Poly Vinyl Chloride (PVC)

- Polystyrene (PS)

- Polyethylene (PE)

- Polycarbonate

- Polypropylene

- Polymethyl Methacrylate

- Others

- Thermosetting plastic

- Polyurethane

- Others

Market by Application:

- Flooring

- Wood Plastic Composite

- Luxury Vinyl Tile

- Stone Plastic Composite

- Others

- Window and door panels

- Siding

- Piping

- Roofing

- Insulation

- Others

On the basis of geography, the global building and construction plastics market is classified into four regions, which includes:

- North America: the United States & Canada

- Europe: the United Kingdom, Germany, France, Spain, Italy & the Rest of Europe

- Asia-Pacific: China, Japan, India, Australia, South Korea, Vietnam & the Rest of Asia Pacific

- Rest of World: Latin America, Middle East & Africa

Geographically, Asia Pacific had been the largest market with a market share of 50.11% in terms of revenue by 2018. An increased government and private spending on the construction sector is helping the industry to stride into the peak position in the world. Since the past half-decade, even the uncertain real estate industry is showing potential, and at present, it accounts for around 75% of the overall construction in the worldwide construction industry. In the Asia Pacific region, the population boom, along with the mounting demand for plastic materials attributes to the dominance of the region in the market. Other factors driving the growth of the market include rising demand for plastics for roofing & cladding applications and green building practices in this region. Many key players are producing innovative products to reduce plastic waste and curb energy costs, which is supplementing the growth of the market in the Asia Pacific region. Additionally, the untapped construction plastics market in Vietnam is also contributing to the growth of the market.

Global building and construction plastic market have been segmented on the basis of type and application. The type segment is sub-segmented into thermoplastic and thermosetting plastic. The application segment is sub-segmented into window and door panels, flooring, piping, siding, roofing, insulation, and others.

The market has a number of players, and some of the chief players involved in the global building and construction plastic market are:

- BASF SE

- SABIC

- Solvay SA

- Arkema SA

- Cork Plastics

- And others.

Company profiles of prominent market players have been discussed in detail. Market players are focusing on several organic & inorganic growth strategies in order to gain a competitive advantage over other companies. For example, in May 2019, DSM announced a partnership with Adaptive3D, which is the premium additive manufacturing polymer resin supplier. This partnership will help produce, distribute, and sell a 3D printable photopolymer.

Key findings of the global building and construction plastic market are:

- Growing demand for green building activities is escalating the growth of the building and construction plastics market in the forecast period 2019-2027

- The Asia Pacific leads the global building and construction plastics market by capturing the largest market share of around 50.11% in 2018

- The continued rise of thermoplastics augmented the growth of building and construction plastics market for the forecast period

- The piping segment accounts for the largest share in building and construction plastics and is projected to grow with a CAGR of XX% during the forecasted period

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- ASIA PACIFIC DOMINATES THE OVERALL MARKET

- INCREASING DEMAND FOR THERMOPLASTIC RAISES THE MARKET GROWTH

- SURGE IN PIPING INDUSTRY IS EFFECTIVE FOR THE MARKET GROWTH

- MARKET DYNAMICS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- SURGE IN CONSTRUCTION ACTIVITIES

- GROWING DEMAND FOR PLASTIC PRODUCTS

- MARKET RESTRAINTS

- STRICT LAWS BY REGULATORY FIRMS

- MARKET OPPORTUNITIES

- GROWING DEMAND FOR GREEN BUILDINGS

- INCREASED USAGE OF RECYCLED PLASTICS IN CONSTRUCTION

- MARKET CHALLENGES

- HIGH COMPETITION FROM SUBSTITUTE PRODUCTS

- MARKET BY PRODUCT TYPE

- THERMOPLASTIC

- POLY VINYL CHLORIDE (PVC)

- POLYSTYRENE (PS)

- POLYETHYLENE (PE)

- POLYCARBONATE

- POLYPROPYLENE

- POLY METHYL METHACRYLATE

- OTHERS

- THERMOSETTING PLASTIC

- POLYURETHANE

- OTHERS

- THERMOPLASTIC

- MARKET BY APPLICATION

- FLOORING

- WOOD PLASTIC COMPOSITE

- LUXURY VINYL TILES

- STONE PLASTIC COMPOSITE

- OTHERS

- WINDOW AND DOOR PANELS

- SIDING

- PIPING

- ROOFING

- INSULATION

- OTHERS

- FLOORING

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF COMPETITIVE RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- AUSTRALIA

- VIETNAM

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- ARKEMA SA

- B&F PLASTICS

- BASF SE

- BOREALIS AG

- CHEVRON PHILLIPS CHEMICAL COMPANY LLC

- CORK PLASTICS

- DOWDUPONT INC.

- INEOS GROUP HOLDING S.A.

- KONINKLIJKE DSM N.V

- LANXESS AKTIENGESELLSCHAFT

- LG CHEM

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- PETROCHINA

- SABIC

- SOLVAY SA

LIST OF TABLES

TABLE 1. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY PRODUCT TYPE, 2019-2027 (IN $ MILLION)

TABLE 3. GLOBAL THERMOPLASTIC MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 4. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY THERMOPLASTIC, 2019-2027 (IN $ MILLION)

TABLE 5. GLOBAL POLY VINYL CHLORIDE (PVC) MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 6. GLOBAL POLYSTYRENE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 7. GLOBAL POLYETHYLENE (PE) MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 8. GLOBAL POLYCARBONATE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 9. GLOBAL POLYPROPYLENE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 10. GLOBAL POLY METHYL METHACRYLATE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 11. GLOBAL OTHERS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 12. GLOBAL THERMOSETTING PLASTIC MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 13. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY THERMOSETTING, 2019-2027 (IN $ MILLION)

TABLE 14. GLOBAL POLYURETHANE MARKET BY REGION, 2019-2027 (IN $ MILLION)

TABLE 15. GLOBAL OTHERS MARKET BY REGION, 2019-2027 (IN $ MILLION)

TABLE 16. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY APPLICATION, 2019-2027 (IN $ MILLION)

TABLE 17. GLOBAL FLOORING MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 18. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY FLOORING, 2019-2027 (IN $ MILLION)

TABLE 19. GLOBAL WOOD PLASTIC COMPOSITE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 20. GLOBAL LUXURY VINYL TILES MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 21. GLOBAL STONE PLASTIC COMPOSITE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 22. GLOBAL OTHERS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 23. GLOBAL WINDOW AND DOOR PANELS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 24. GLOBAL SIDING MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 25. GLOBAL PIPING MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 26. GLOBAL ROOFING MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 27. GLOBAL INSULATION MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 28. GLOBAL OTHERS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 29. OPPORTUNITY MATRIX

TABLE 30. VENDOR LANDSCAPE

TABLE 31. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 32. NORTH AMERICA BUILDING AND CONSTRUCTION PLASTICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 33. EUROPE BUILDING AND CONSTRUCTION PLASTICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 34. ASIA PACIFIC BUILDING AND CONSTRUCTION PLASTICS MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 35. REST OF WORLD-BUILDING AND CONSTRUCTION PLASTICS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

LIST OF FIGURES

FIGURE 1. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY TYPE, 2018 & 2027 (IN %)

FIGURE 2. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY THERMOPLASTIC, 2019-2027 (IN $ MILLION)

FIGURE 3. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY POLYVINYL CHLORIDE (PVC), 2019-2027 (IN $ MILLION)

FIGURE 4. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY POLYSTYRENE (PS), 2019-2027 (IN $ MILLION)

FIGURE 5. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY POLYETHYLENE (PE), 2019-2027 (IN $ MILLION)

FIGURE 6. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY POLYCARBONATE, 2019-2027 (IN $ MILLION)

FIGURE 7. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY POLYPROPYLENE, 2019-2027 (IN $ MILLION)

FIGURE 8. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY POLY METHYL METHACRYLATE, 2019-2027 (IN $ MILLION)

FIGURE 9. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 10. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY THERMOSETTING PLASTIC, 2019-2027 (IN $ MILLION)

FIGURE 11. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY POLYURETHANE, 2019-2027 (IN $ MILLION)

FIGURE 12. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 13. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY FLOORING, 2019-2027 (IN $ MILLION)

FIGURE 14. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY WOOD PLASTIC COMPOSITE, 2019-2027 (IN $ MILLION)

FIGURE 15. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY LUXURY VINYL TILES, 2019-2027 (IN $ MILLION)

FIGURE 16. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY STONE PLASTIC COMPOSITE, 2019-2027 (IN $ MILLION)

FIGURE 17. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 18. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY WINDOW AND DOOR PANELS, 2019-2027 (IN $ MILLION)

FIGURE 19. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY SIDING, 2019-2027 (IN $ MILLION)

FIGURE 20. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY PIPING, 2019-2027 (IN $ MILLION)

FIGURE 21. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY ROOFING, 2019-2027 (IN $ MILLION)

FIGURE 22. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY INSULATION, 2019-2027 (IN $ MILLION)

FIGURE 23. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, BY OTHERS, 2019-2027 (IN $ MILLION)

FIGURE 24. PORTER’S FIVE FORCE ANALYSIS

FIGURE 25. GLOBAL BUILDING AND CONSTRUCTION PLASTICS MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 26. UNITED STATES BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27. CANADA BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28. UNITED KINGDOM BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29. GERMANY BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30. FRANCE BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31. SPAIN BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32. ITALY BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 33. REST OF EUROPE BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 34. CHINA BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 35. JAPAN BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 36. INDIA BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 37. SOUTH KOREA BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 38. AUSTRALIA BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 39. VIETNAM BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 40. REST OF ASIA PACIFIC BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 41. LATIN AMERICA BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

FIGURE 42. MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION PLASTICS MARKET, 2019-2027 (IN $ MILLION)

- MARKET BY PRODUCT TYPE

- THERMOPLASTIC

- POLY VINYL CHLORIDE (PVC)

- POLYSTYRENE (PS)

- POLYETHYLENE (PE)

- POLYCARBONATE

- POLYPROPYLENE

- POLY METHYL METHACRYLATE

- OTHERS

- THERMOSETTING PLASTIC

- POLYURETHANE

- OTHERS

- THERMOPLASTIC

- MARKET BY APPLICATION

- FLOORING

- WOOD PLASTIC COMPOSITE

- LUXURY VINYL TILES

- STONE PLASTIC COMPOSITE

- OTHERS

- WINDOW AND DOOR PANELS

- SIDING

- PIPING

- ROOFING

- INSULATION

- OTHERS

- FLOORING

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- AUSTRALIA

- VIETNAM

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.