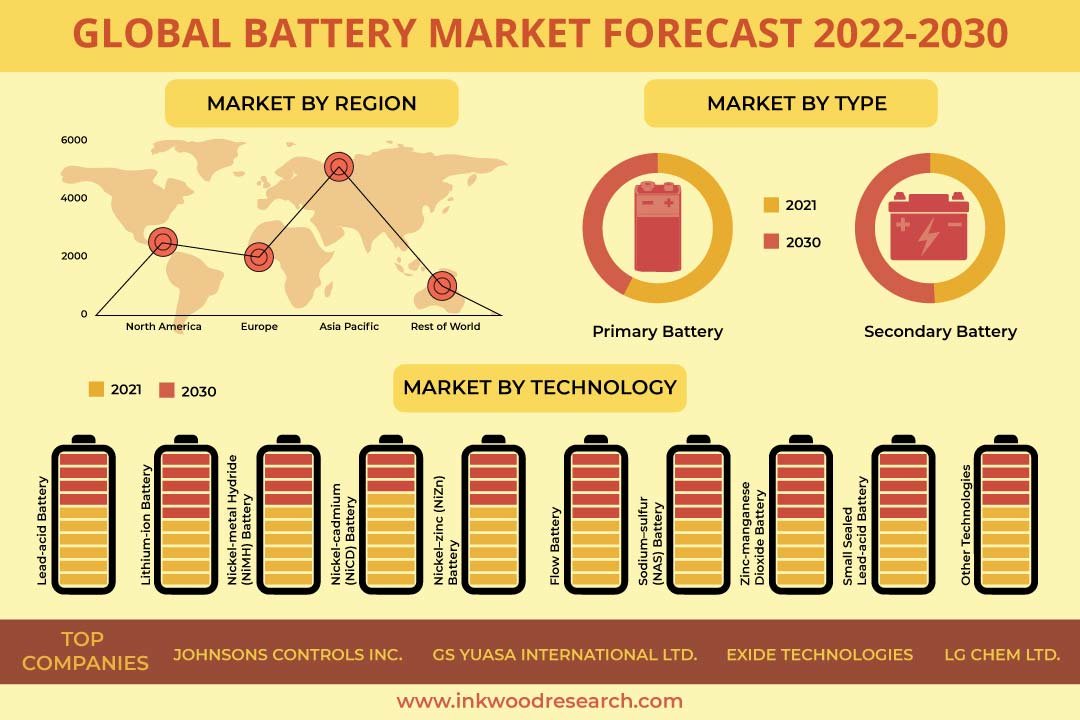

GLOBAL BATTERY MARKET FORECAST 2022-2030

Global Battery Market by Type (Primary Battery, Secondary Battery) Market by Technology (Lead-acid Battery, Lithium-ion Battery, Nickel-cadmium Battery, Nickel Metal Hydride Battery, Nickel-zinc Battery, Flow Battery, Sodium-sulfur Battery, Zinc-manganese Dioxide Battery, Small Sealed Lead-acid Battery, Other Batteries) Market by Application (Automotive Batteries, Industrial Batteries, Portable Batteries, Power Tools Batteries, Sli Batteries, Other Applications) by Geography

In terms of revenue, the global battery market was valued at $111.86 billion in the year 2021 and is projected to reach $423.90 billion by 2030, growing with a CAGR of 16.68% over the forecasting years of 2022 to 2030. The market study has also analyzed the impact of COVID-19 on the battery market qualitatively as well as quantitatively.

To know more about this report, request a free sample copy

An electric battery is an electric power source comprising one or more electrochemical cells, along with external connections to power electrical devices. It stores chemical energy and then converts it into electrical energy. The chemical reactions within batteries involve electron flow from one electrode to another via an external circuit. Subsequently, the flow of electrons offers an electric current that can be used to perform tasks.

Read our latest blog on the Battery Market

Key growth enablers of the global battery market:

- Increasing popularity of consumer electronics

- Lithium-ion batteries are among the most common types of high-capacity secondary batteries utilized in electronic devices such as laptops, mobile phones, computers, cameras, and others. This battery technology is highly popular as it is relatively affordable, offers high power density, and does not self-discharge quickly.

- The rising demand for consumer electronics across the globe is anticipated to increase the demand, as well as the adoption of different batteries for a range of consumer electronic devices. For instance, across sales categories of consumer electronics, computers (+34%), as well as TV sets (+12%), have grown relatively faster as compared to smartphones (+1%) in the last three years (2019-2021) worldwide. This is majorly due to COVID-19 restrictions, in addition to more time spent learning and working from home.

- Incentives for EV battery manufacturing

- Declining prices of batteries

- High demand for automotive applications especially from electric vehicles

Key growth restraining factors:

- Safety issues related to battery usage

- The safety features of a battery are profoundly determined by the chemistry of the battery, its operating environment, and abuse tolerance.

- The internal failure of a battery, primarily a lithium-ion battery, is caused by the instability occurring in the electrochemical system. Therefore, understanding material properties, electrochemical reactions, and side reactions in the battery are fundamental for assessing its safety.

- Temperature and voltage are the two main factors that control battery reactions. Safety accidents are followed by continuous gas and heat generation, resulting in battery rupture and further ignition of combustible products.

- Volatility in raw material prices

- Issues related to battery recycling

Global Battery Market | Top Trends

- Rising demand for energy storage systems

- There has been an increase in the demand for energy storage systems across the globe. Energy storage can play a crucial role in balancing variable generation sources and grid integration.

- In this regard, by increasing the overall flexibility of the system, energy storage systems can reduce peak demand, improve power quality, avoid/reduce deviation penalties, and enhance the capacity of distribution/transmission grids.

- Emergence of AGM batteries

- AGM (Absorbent Glass Mat) batteries are an advanced type of lead-acid batteries that offer superior power to support the higher electrical requirements of present-day vehicles and start-stop applications. Such batteries are extremely resistant to vibration and are completely non-spillable, sealed, as well as maintenance-free.

- Moreover, they also provide better cycling performance, minimal gassing, and acid leakage as compared to conventional lead-acid batteries.

- Research and development in batteries

- Increasing penetration of marine batteries

- Marine batteries are specifically designed for use on a boat, with robust construction and heavier plates that are designed to withstand the pounding and vibration that can occur onboard any powerboat.

- There are three major types of marine batteries: marine starting batteries, marine deep cycle batteries, and marine dual-purpose batteries.

- While there has been an increase in the penetration of marine batteries, market players across the globe are also developing and launching a range of technologically advanced and innovative products catering to the requirements of end-users.

Market Segmentation – Type, Technology, and Application –

Market by Type:

- Primary Battery

- Secondary Battery

Market by Technology:

- Lead-Acid Battery

- Lithium-Ion Battery

- The lithium-ion battery segment, under the technology category, is set to capture the highest market share by 2030.

- A lithium-ion battery is a type of rechargeable battery composed of cells where lithium ions move from the negative to the positive electrode via an electrolyte during discharge, and back during charging.

- The battery’s applications include a wide range of products such as toys, electronics, small and large appliances, wireless headphones, handheld power tools, electrical energy storage systems, electric vehicles, and others. This factor, in turn, is expected to contribute to the segment’s growth during the forecast period.

- Nickel-Zinc (NiZn) Battery

- Flow Battery

- Nickel-Cadmium Battery

- Nickel Metal Hydride Battery

- Zinc-Manganese Dioxide Battery

- Small Sealed Lead-Acid Battery

- Sodium-Sulfur (NAS) Battery

- Other Technologies

Market by Application:

- Automotive Batteries

- Automotive batteries is anticipated to be the leading as well as dominating application during the forecast period.

- A wide range of batteries is being widely used in the automotive sector, which includes hybrid electric vehicles, electric vehicles, and others. An automotive battery is used to power the electrical systems of vehicles when the engine is turned off. Also, it is used to start the engine, offering current for the electric starter motor and the ignition system.

- Growth in the automotive sector across the globe and product developments and launches by the market players are some of the major factors contributing to the segment’s growth during the forecast period.

- For instance, as per OICA, the total sales of all vehicles globally increased from 78.7 million in 2020 to 82.6 million in 2021. Further, according to IEA, electric car sales globally reached a record 3 million in 2020, up by 40% from 2019. The significant growth in the sales of different automobiles is estimated to further increase the demand as well as the adoption of a range of batteries, catering to the requirements of consumers.

- Industrial Batteries

- Portable Batteries

- Power Tools Batteries

- SLI Batteries

- Other Applications

Geographical Study Based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, and Rest of Europe

- Asia-Pacific: China, South Korea, Australia & New Zealand, Japan, India, and Rest of Asia-Pacific

- The Asia-Pacific is evaluated to be the fastest-growing region over the forecast years.

- In developed and developing economies of the Asia-Pacific, the adoption of electric vehicles is continuously increasing at a higher rate. China leads the global sales of electric vehicles, with other developing economies such as India transforming their public transportation infrastructure for electric vehicles.

- Moreover, the increasing need for electric vehicles is a major driving factor promoting the growth of the battery market in the Asia-Pacific during the forecast period.

- Also, the developing renewable sector, increased sales of consumer electronics, growth in the number of data centers, and the rising popularity of electric vehicles are projected to support the growth of the region’s battery market during the forecast period.

- Rest of World: Latin America, the Middle East & Africa

Major players in the global battery market:

- GS Yuasa International Ltd

- Exide Technologies

- LG Chem Ltd

- A123 Systems LLC

- Toshiba Corporation

Key strategies adopted by some of these companies:

In 2021, Tesla signed a new battery cell agreement (long term) with CATL (the largest battery manufacturer in China) with the intent to acquire a large battery supply in the auto industry.

In 2020, Saft announced the launch of a new brand of batteries, Saft Urja, in India for industrial and off-grid solar applications. Saft Urja is involved in manufacturing battery systems with nickel technology for utilities, industrial power backup, oil & gas, metro operators, and railways. These batteries are well equipped to perform operations in difficult, hostile terrains such as the Himalayan area as well as Kutch and Thar deserts’ hot climes.

Report Synopsis:

| Report Scope | Details |

| Market Forecast Years | 2022-2030 |

| Base Year | 2021 |

| Market Historical Years | 2018-2021 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Type, Technology, and Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, and Rest of World |

| Companies Analyzed | Johnsons Controls Inc, GS Yuasa International Ltd, Exide Technologies, LG Chem Ltd, A123 Systems LLC, Toshiba Corporation, Panasonic Corporation, Samsung SDI Co Ltd, Saft Groupe SA, Trojan Battery Company, BYD Company Ltd, NEC Corporation, Eveready Industries, Duracell, East Penn Manufacturing Co, Crown Battery Manufacturing Company, C&D Technologies Inc, Enersys, Murata Manufacturing Co Ltd, Shenzhen Bak Battery Co Ltd |

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- INCREASING POPULARITY OF CONSUMER ELECTRONICS

- INCENTIVES FOR EV BATTERY MANUFACTURING

- DECLINING PRICES OF BATTERIES

- HIGH DEMAND FOR AUTOMOTIVE APPLICATIONS ESPECIALLY FROM ELECTRIC VEHICLES

- KEY RESTRAINTS

- SAFETY ISSUES RELATED TO BATTERY USAGE

- VOLATILITY IN RAW MATERIAL PRICES

- ISSUES RELATED TO BATTERY RECYCLING

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON BATTERY MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY BUYING CRITERIA

- ENERGY DENSITY

- BATTERY MEMORY

- LIFETIME

- DURABILITY

- VALUE CHAIN ANALYSIS

- LEGAL, POLICY & REGULATORY FRAMEWORK

- BATTERY/RAW MATERIAL PRICE TRENDS AND FORECAST, BY MAJOR TECHNOLOGY TYPE

- IMPORT AND EXPORT ANALYSIS, BY MAJOR TECHNOLOGY TYPE AND MAJOR COUNTRIES

- MARKET BY TYPE

- PRIMARY BATTERY

- SECONDARY BATTERY

- MARKET BY TECHNOLOGY

- LEAD-ACID BATTERY

- LITHIUM-ION BATTERY

- NICKEL-CADMIUM BATTERY

- NICKEL METAL HYDRIDE BATTERY

- NICKEL-ZINC (NIZN) BATTERY

- FLOW BATTERY

- SODIUM-SULFUR (NAS) BATTERY

- ZINC-MANGANESE DIOXIDE BATTERY

- SMALL SEALED LEAD-ACID BATTERY

- OTHER BATTERIES

- MARKET BY APPLICATION

- AUTOMOTIVE BATTERIES

- INDUSTRIAL BATTERIES

- PORTABLE BATTERIES

- POWER TOOLS BATTERIES

- SLI BATTERIES

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PRODUCT LAUNCHES & DEVELOPMENTS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- A123 SYSTEMS LLC

- BYD COMPANY LTD

- C&D TECHNOLOGIES INC

- CROWN BATTERY MANUFACTURING COMPANY

- DURACELL

- EAST PENN MANUFACTURING CO

- ENERSYS

- EVEREADY INDUSTRIES

- EXIDE TECHNOLOGIES

- GS YUASA INTERNATIONAL LTD

- JOHNSONS CONTROLS INC

- LG CHEM LTD

- MURATA MANUFACTURING CO LTD

- NEC CORPORATION

- PANASONIC CORPORATION

- SAFT GROUPE SA

- SAMSUNG SDI CO LTD

- SHENZHEN BAK BATTERY CO LTD

- TOSHIBA CORPORATION

- TROJAN BATTERY COMPANY

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – BATTERY

TABLE 2: LEGAL, POLICY & REGULATORY FRAMEWORK

TABLE 3: GLOBAL BATTERY MARKET, BY TYPE, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 4: GLOBAL BATTERY MARKET, BY TYPE, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 5: GLOBAL PRIMARY BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 6: GLOBAL PRIMARY BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 7: GLOBAL SECONDARY BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 8: GLOBAL SECONDARY BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 9: GLOBAL BATTERY MARKET, BY TECHNOLOGY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 10: GLOBAL BATTERY MARKET, BY TECHNOLOGY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 11: GLOBAL LEAD-ACID BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 12: GLOBAL LEAD-ACID BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 13: GLOBAL LITHIUM-ION BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 14: GLOBAL LITHIUM-ION BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 15: GLOBAL NICKEL-CADMIUM BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 16: GLOBAL NICKEL-CADMIUM BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 17: GLOBAL NICKEL METAL HYDRIDE BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 18: GLOBAL NICKEL METAL HYDRIDE BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 19: GLOBAL NICKEL-ZINC (NIZN) BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 20: GLOBAL NICKEL-ZINC (NIZN) BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 21: GLOBAL FLOW BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 22: GLOBAL FLOW BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 23: GLOBAL SODIUM-SULFUR (NAS) BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 24: GLOBAL SODIUM-SULFUR (NAS) BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 25: GLOBAL ZINC-MANGANESE DIOXIDE BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 26: GLOBAL ZINC-MANGANESE DIOXIDE BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 27: GLOBAL SMALL SEALED LEAD-ACID BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 28: GLOBAL SMALL SEALED LEAD-ACID BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 29: GLOBAL OTHER BATTERIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 30: GLOBAL OTHER BATTERIES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 31: GLOBAL BATTERY MARKET, BY APPLICATION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 32: GLOBAL BATTERY MARKET, BY APPLICATION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 33: GLOBAL AUTOMOTIVE BATTERIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 34: GLOBAL AUTOMOTIVE BATTERIES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 35: GLOBAL INDUSTRIAL BATTERIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 36: GLOBAL INDUSTRIAL BATTERIES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 37: GLOBAL PORTABLE BATTERIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 38: GLOBAL PORTABLE BATTERIES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 39: GLOBAL POWER TOOLS BATTERIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 40: GLOBAL POWER TOOLS BATTERIES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 41: GLOBAL SLI BATTERIES MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 42: GLOBAL SLI BATTERIES MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 43: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 44: GLOBAL OTHER APPLICATIONS MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 45: GLOBAL BATTERY MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 46: GLOBAL BATTERY MARKET, BY GEOGRAPHY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 47: NORTH AMERICA BATTERY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 48: NORTH AMERICA BATTERY MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 49: LEADING PLAYERS OPERATING IN NORTH AMERICA BATTERY MARKET

TABLE 50: EUROPE BATTERY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 51: EUROPE BATTERY MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 52: LEADING PLAYERS OPERATING IN EUROPE BATTERY MARKET

TABLE 53: ASIA-PACIFIC BATTERY MARKET, BY COUNTRY, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 54: ASIA-PACIFIC BATTERY MARKET, BY COUNTRY, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 55: LEADING PLAYERS OPERATING IN ASIA-PACIFIC BATTERY MARKET

TABLE 56: REST OF WORLD BATTERY MARKET, BY REGION, HISTORICAL YEARS, 2018-2021 (IN $ MILLION)

TABLE 57: REST OF WORLD BATTERY MARKET, BY REGION, FORECAST YEARS, 2022-2030 (IN $ MILLION)

TABLE 58: LEADING PLAYERS OPERATING IN REST OF WORLD BATTERY MARKET

TABLE 59: LIST OF MERGERS & ACQUISITIONS

TABLE 60: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 61: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 62: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: KEY BUYING CRITERIA

FIGURE 6: VALUE CHAIN ANALYSIS

FIGURE 7: GLOBAL BATTERY MARKET, GROWTH POTENTIAL, BY TYPE, IN 2021

FIGURE 8: GLOBAL BATTERY MARKET, BY PRIMARY BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 9: GLOBAL BATTERY MARKET, BY SECONDARY BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 10: GLOBAL BATTERY MARKET, GROWTH POTENTIAL, BY TECHNOLOGY, IN 2021

FIGURE 11: GLOBAL BATTERY MARKET, BY LEAD-ACID BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 12: GLOBAL BATTERY MARKET, BY LITHIUM-ION BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 13: GLOBAL BATTERY MARKET, BY NICKEL-CADMIUM BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 14: GLOBAL BATTERY MARKET, BY NICKEL METAL HYDRIDE BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 15: GLOBAL BATTERY MARKET, BY NICKEL-ZINC (NIZN) BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 16: GLOBAL BATTERY MARKET, BY FLOW BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 17: GLOBAL BATTERY MARKET, BY SODIUM-SULFUR (NAS) BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 18: GLOBAL BATTERY MARKET, BY ZINC-MANGANESE DIOXIDE BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 19: GLOBAL BATTERY MARKET, BY SMALL SEALED LEAD-ACID BATTERY, 2022-2030 (IN $ MILLION)

FIGURE 20: GLOBAL BATTERY MARKET, BY OTHER BATTERIES, 2022-2030 (IN $ MILLION)

FIGURE 21: GLOBAL BATTERY MARKET, GROWTH POTENTIAL, BY APPLICATION, IN 2021

FIGURE 22: GLOBAL BATTERY MARKET, BY AUTOMOTIVE BATTERIES, 2022-2030 (IN $ MILLION)

FIGURE 23: GLOBAL BATTERY MARKET, BY INDUSTRIAL BATTERIES, 2022-2030 (IN $ MILLION)

FIGURE 24: GLOBAL BATTERY MARKET, BY PORTABLE BATTERIES, 2022-2030 (IN $ MILLION)

FIGURE 25: GLOBAL BATTERY MARKET, BY POWER TOOLS BATTERIES, 2022-2030 (IN $ MILLION)

FIGURE 26: GLOBAL BATTERY MARKET, BY SLI BATTERIES, 2022-2030 (IN $ MILLION)

FIGURE 27: GLOBAL BATTERY MARKET, BY OTHER APPLICATIONS, 2022-2030 (IN $ MILLION)

FIGURE 28: NORTH AMERICA BATTERY MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 29: UNITED STATES BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 30: CANADA BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 31: EUROPE BATTERY MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 32: UNITED KINGDOM BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 33: GERMANY BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 34: FRANCE BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 35: SPAIN BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 36: ITALY BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 37: REST OF EUROPE BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 38: ASIA-PACIFIC BATTERY MARKET, COUNTRY OUTLOOK, 2021 & 2030 (IN %)

FIGURE 39: CHINA BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 40: JAPAN BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 41: INDIA BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 42: SOUTH KOREA BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 43: AUSTRALIA & NEW ZEALAND BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 44: REST OF ASIA-PACIFIC BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 45: REST OF WORLD BATTERY MARKET, REGIONAL OUTLOOK, 2021 & 2030 (IN %)

FIGURE 46: LATIN AMERICA BATTERY MARKET, 2022-2030 (IN $ MILLION)

FIGURE 47: MIDDLE EAST & AFRICA BATTERY MARKET, 2022-2030 (IN $ MILLION)

- MARKET BY TYPE

- PRIMARY BATTERY

- SECONDARY BATTERY

- MARKET BY TECHNOLOGY

- LEAD-ACID BATTERY

- LITHIUM-ION BATTERY

- NICKEL-CADMIUM BATTERY

- NICKEL METAL HYDRIDE BATTERY

- NICKEL-ZINC (NIZN) BATTERY

- FLOW BATTERY

- SODIUM-SULFUR (NAS) BATTERY

- ZINC-MANGANESE DIOXIDE BATTERY

- SMALL SEALED LEAD-ACID BATTERY

- OTHER BATTERIES

- MARKET BY APPLICATION

- AUTOMOTIVE BATTERIES

- INDUSTRIAL BATTERIES

- PORTABLE BATTERIES

- POWER TOOLS BATTERIES

- SLI BATTERIES

- OTHER APPLICATIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- SPAIN

- ITALY

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY GROWTH ENABLERS

- KEY CHALLENGES

- KEY PLAYERS

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.

Frequently Asked Questions (FAQs):

What is the worth of North America battery market?

The North America battery market was valued at $25240.33 million in 2021.

Which is the dominating battery application in the global battery market?

In 2021, SLI batteries was the dominating application in the global battery market.

To request a free sample copy of this report, please complete the form below:

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.