GLOBAL BAGGAGE HANDLING SYSTEM MARKET FORECAST 2019-2027

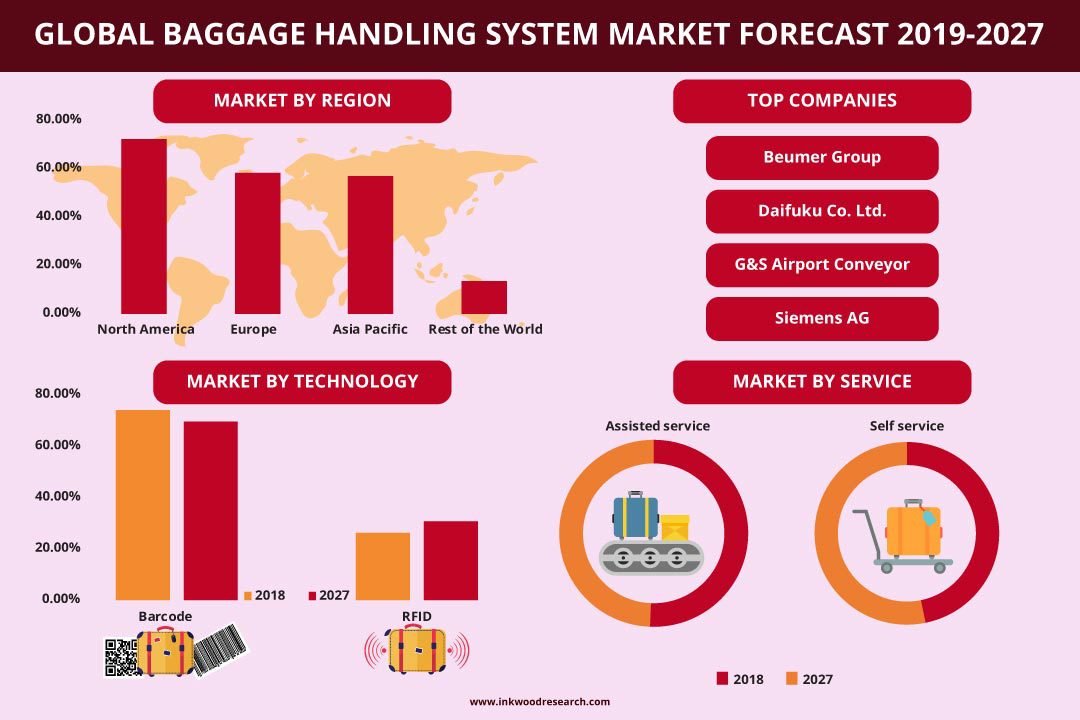

Global Baggage Handling System Market by Airport Class (Class a, Class B, Class C) by Service (Assisted Service, Self Service) by Type (Conveyors, Destination Coded Vehicles) by Technology (Barcode, Rfid) by Geography.

The baggage handling system is an intricate infrastructure or system used to transport luggage from the aircraft to the baggage claim area and vice versa. Various automated carts, conveyors, destination coded vehicles, and other various mechanisms are used in this process. This system also uses technologies such as barcode scanners and RFID sensors for the processing. The global baggage handling system market was valued at $8496 billion in 2018 & is estimated to generate net revenue of approximately $16424.66 million by 2027, growing at a CAGR of 7.50%. The base year considered for the study is 2018, and the estimated period is between 2019-2027. The growth of this market is driven by the following factors:

- Growth in the air travel industry

- Upgradation of Airports

- Increase in technological innovations

- Increasing security concerns

Growth in the air travel industry is the main driver for the market. The current air travel market is growing, and the passenger number travelling by air has also increased. This is mainly due to the growing global economy and the need for faster means of transport. Airports and airlines invest heavily in baggage handling technology as it increases the efficiency of airports management.

In 2018, Conveyor segment accounted for the largest revenue share of 66.47% of the market by type segment. The conveyor belt is the conventional method used in baggage check-in procedures that sorts, merges, and accumulates with the help of motile belts. There are numerous conveyor belts used in the baggage handling process with junctions connecting each one of them. The conveyor system sorts the bag from different airlines and transfers them to destination coded vehicle (DCV) that are headed to terminals. The fastest growing segment by type is Destination Coded Vehicles (DCV) systems, which is also known as Individual Carrier Systems (ICS). The system is used for carrying single baggage units into mainly tubs or cart and transported further to the desired destinations for baggage offloading.

The market growth is restrained by the high investment required for baggage handling system & problems associated with system failure. The initial investment for the construction of a baggage handling system is high. The overall cost for the functioning of a baggage handling system is high as well due to various cost factors. Firstly, the complete system is expensive as numerous parts used for the construction of a baggage handling system such as RFID sensors, conveyor belts, screening machine, X-ray and others require a lot of funds. In addition to this, the maintenance cost, salaries of employees, and electricity increase the capital required for installing the baggage handling system.

The report on global baggage handling system market includes segmentation on the basis of Airport Class, Service, Type, Technology and Airport Capacity.

Airport Class is sub-segmented into:

- Class A

- Class B

- Class C

Service is sub-segmented into:

- Assisted service

- Self-service

Type is sub-segmented into:

- Conveyors

- Destination Coded Vehicles

Technology is sub-segmented into:

- Barcode

- RFID

Airport Capacity is sub-segmented into:

- Up to 15 million

- 15-25 million

- 25-40 million

- 40 million+

Geographically, the global baggage handling system market has been segmented on the basis of four major regions, which includes:

- North America Baggage Handling System Market: the United States & Canada

- Europe Baggage Handling System Market: Germany, United Kingdom, France, Spain, Italy, Russia & Rest of Europe

- Asia Pacific Baggage Handling System Market: China, India, South Korea, Japan, Australia & Rest of Asia Pacific

- Rest of World: Latin America, Middle East & Africa

The largest market for the baggage handling system belongs to that of the North American region. North America market mainly includes the economies if the United States & Canada. The United States has the largest market share in this region. There are numerous expansion plans of airports and government in these countries which will be heavily investing in baggage handling systems due to a high number of baggage mishandling cases. With the year-on-year increase in air passenger traffic, the demand for baggage-handling systems is also increasing. Installing heavy-capacity baggage systems can save passenger time and can reduce the risk of handling baggage at peak hours when traffic is high.

The fastest growing market hails from the Europe region. United Kingdom, France, Italy and Germany are the major contributors to the baggage handling system market; however, Russia faced a high rise in passengers due to recent hosting of the FIFA World Cup 2018, due to which they expanded the airport terminals and installed new baggage handling units in order to minimize the check-in time of passengers.

The global baggage handling system market segmented into the market by Airport Class, Service, Type, Technology and Airport Capacity. Airport class segment is further sub segmented into Class A, Class B, Class C. Service segment is further sub segmented into assisted service & Self-service. Type segment is further sub segmented into Conveyors & Destination Coded Vehicles. The technology segment is further sub segmented into Barcode & RFID. Airport Capacity segment is further sub-segmented into Up to 15 million, 15-25 million, 25-40 million & 40 million+.

The major market players in the global baggage handling system market include:

- Beumer Group

- Daifuku Co. Ltd.

- G&S Airport Conveyor

- Siemens AG

- Vanderlande Industries B.V

- Others.

Company profiles section covers the analysis of important players. These companies are using organic and inorganic strategies for growth. For instance, in May 2019 Vanderlande signed a contract to bring an upgrade to the baggage handling system at Brussels Airport. In January 2019, the market saw a $33 million worth strategic agreement between Aruba’s Queen Beatrix International Airport and Beumer Group. According to the agreement, Beumer Group will design & deploy a high-speed baggage transportation and sortation system at the airport. In April 2019, Daifuku Co., Ltd. had acquired an Indian company named Vega Conveyors & Automation Private Limited.

Key findings of the global baggage handling system market are:

- Growing in demand for M2MI Interface due to for the enhancement of passenger travel experience by reducing baggage misplacements and losses due to baggage mishandling.

- Data relating to passengers, staff, and operations are growing at an exponential rate, which is causing the adoption of big data in the baggage handling system market.

- The growing need for intelligent connectivity among stakeholders in the aviation industry is driving the need for a connected ecosystem.

- RESEARCH SCOPE

- STUDY GOALS

- SCOPE OF THE MARKET STUDY

- WHO WILL FIND THIS REPORT USEFUL?

- STUDY AND FORECASTING YEARS

- RESEARCH METHODOLOGY

- SOURCES OF DATA

- SECONDARY DATA

- PRIMARY DATA

- TOP-DOWN APPROACH

- BOTTOM-UP APPROACH

- DATA TRIANGULATION

- SOURCES OF DATA

- EXECUTIVE SUMMARY

- MARKET SUMMARY

- KEY FINDINGS

- INCREASE IN DEMAND FOR M2MI INTERFACE

- GROWING ADOPTION OF BIG DATA IN BAGGAGE HANDLING SYSTEM MARKET

- GROWING NEED FOR CONNECTED AVIATION ECOSYSTEM

- MARKET DYNAMICS

- MARKET SCOPE & DEFINITION

- MARKET DRIVERS

- GROWTH IN AIR TRAVEL INDUSTRY

- UPGRADATION OF AIRPORTS

- INCREASE IN TECHNOLOGICAL INNOVATIONS

- INCREASING SECURITY CONCERNS

- MARKET RESTRAINTS

- HIGH INVESTMENT REQUIRED FOR BAGGAGE HANDLING SYSTEM

- PROBLEMS ASSOCIATED WITH SYSTEM FAILURE

- MARKET OPPORTUNITIES

- AUTOMATION USING ROBOTS WILL BE AN EMERGING TREND

- EMERGENCE OF SMART AIRPORT

- INCREASING NEED FOR FAST INFRASTRUCTURE

- MARKET CHALLENGES

- INCREASE IN NUMBER OF MISHANDLED BAGS

- COMPLEX ARCHITECTURE

- MARKET BY AIRPORT CLASS

- CLASS A

- CLASS B

- CLASS C

- MARKET BY SERVICE

- ASSISTED SERVICE

- SELF SERVICE

- MARKET BY TYPE

- CONVEYORS

- DESTINATION CODED VEHICLES

- MARKET BY TECHNOLOGY

- BARCODE

- RFID

- MARKET BY AIRPORT CAPACITY

- UP TO 15 MILLION

- 15-25 MILLION

- 25-40 MILLION

- 40 MILLION+

- KEY ANALYTICS

- PORTER’S FIVE FORCE MODEL

- THREAT OF NEW ENTRANTS

- THREAT OF SUBSTITUTE

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- INTENSITY OF COMPETITIVE RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- PORTER’S FIVE FORCE MODEL

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- SPAIN

- ITALY

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- SOUTH KOREA

- JAPAN

- AUSTRALIA

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- BABCOCK INTERNATIONAL

- LOGPLAN

- SITA

- VANDERLANDE INDUSTRIES B.V.

- ANSIR SYSTEMS

- BEUMER A/G

- DAIFUKU CO. LTD.

- FIVES GROUP

- G&S AIRPORT CONVEYER

- GLIDEPATH GROUP

- GRENZEBACH GROUP

- PTERIS GLOBAL LIMITED (CIMC GROUP)

- SIEMENS AG

- ALSTEF

- SMITH DETECTION

TABLE LIST

TABLE 1: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 2: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY AIRPORT CLASS, 2019-2027 (IN $ MILLION)

TABLE 3: GLOBAL CLASS A MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 4: GLOBAL CLASS B MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 5: GLOBAL CLASS C MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 6: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY SERVICE, 2019-2027 (IN $ MILLION)

TABLE 7: GLOBAL ASSISTED SERVICE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 8: GLOBAL SELF SERVICE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 9: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY TYPE, 2019-2027 (IN $ MILLION)

TABLE 10: GLOBAL CONVEYORS MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 11: GLOBAL DESTINATION CODED VEHICLES MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 12: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY TECHNOLOGY, 2019-2027 (IN $ MILLION)

TABLE 13: GLOBAL BARCODE MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 14: GLOBAL RFID MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 15: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY AIRPORT CAPACITY, 2019-2027 (IN $ MILLION)

TABLE 16: GLOBAL UP TO 15 MILLION MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 17: GLOBAL 15-25 MILLION MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 18: GLOBAL 25-40 MILLION MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 19: GLOBAL 40 MILLION+ MARKET, BY REGION, 2019-2027 (IN $ MILLION)

TABLE 20: OPPORTUNITY MATRIX

TABLE 21: VENDOR LANDSCAPE

TABLE 22: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY GEOGRAPHY, 2019-2027 (IN $ MILLION)

TABLE 23: NORTH AMERICA BAGGAGE HANDLING SYSTEM MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 24: EUROPE BAGGAGE HANDLING SYSTEM MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 25: ASIA PACIFIC BAGGAGE HANDLING SYSTEM MARKET, BY COUNTRY, 2019-2027 (IN $ MILLION)

TABLE 26: REST OF WORLD BAGGAGE HANDLING SYSTEM MARKET, BY REGION, 2019-2027 (IN $ MILLION)

FIGURES LIST

FIGURE 1: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY TYPE, 2018 & 2027 (IN %)

FIGURE 2: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY CLASS A, 2019-2027 (IN $ MILLION)

FIGURE 3: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY CLASS B, 2019-2027 (IN $ MILLION)

FIGURE 4: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY CLASS C, 2019-2027 (IN $ MILLION)

FIGURE 5: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY ASSISTED SERVICE, 2019-2027 (IN $ MILLION)

FIGURE 6: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY SELF SERVICE, 2019-2027 (IN $ MILLION)

FIGURE 7: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY CONVEYORS, 2019-2027 (IN $ MILLION)

FIGURE 8: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY DESTINATION CODED VEHICLES, 2019-2027 (IN $ MILLION)

FIGURE 9: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY BARCODE, 2019-2027 (IN $ MILLION)

FIGURE 10: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY RFID, 2019-2027 (IN $ MILLION)

FIGURE 11: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY UP TO 15 MILLION, 2019-2027 (IN $ MILLION)

FIGURE 12: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY 15-25 MILLION, 2019-2027 (IN $ MILLION)

FIGURE 13: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY 25-40 MILLION, 2019-2027 (IN $ MILLION)

FIGURE 14: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, BY 40 MILLION+, 2019-2027 (IN $ MILLION)

FIGURE 15: PORTER’S FIVE FORCE ANALYSIS

FIGURE 16: GLOBAL BAGGAGE HANDLING SYSTEM MARKET, REGIONAL OUTLOOK, 2018 & 2027 (IN %)

FIGURE 17: UNITED STATES BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 18: CANADA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 19: GERMANY BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 20: UNITED KINGDOM BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 21: FRANCE BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 22: SPAIN BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 23: ITALY BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 24: RUSSIA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 25: REST OF EUROPE BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 26: CHINA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 27: INDIA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 28: SOUTH KOREA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 29: JAPAN BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 30: AUSTRALIA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 31: REST OF ASIA PACIFIC BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 32: LATIN AMERICA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

FIGURE 33: MIDDLE EAST & AFRICA BAGGAGE HANDLING SYSTEM MARKET, 2019-2027 (IN $ MILLION)

- MARKET BY AIRPORT CLASS

- CLASS A

- CLASS B

- CLASS C

- MARKET BY SERVICE

- ASSISTED SERVICE

- SELF SERVICE

- MARKET BY TYPE

- CONVEYORS

- DESTINATION CODED VEHICLES

- MARKET BY TECHNOLOGY

- BARCODE

- RFID

- MARKET BY AIRPORT CAPACITY

- UP TO 15 MILLION

- 15-25 MILLION

- 25-40 MILLION

- 40 MILLION+

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- GERMANY

- UNITED KINGDOM

- FRANCE

- SPAIN

- ITALY

- RUSSIA

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- INDIA

- SOUTH KOREA

- JAPAN

- AUSTRALIA

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.