GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET FORECAST 2021-2028

Global Automotive Paints & Coatings Market by Product Type (Solvent-borne, Water-borne, Other Coatings (Powder Coatings, ETC)) Market by Vehicle Type (Passenger Vehicles, Commercial Vehicles) Market by Texture Type (Solid, Metallic, Pearlescent, Other Texture Type) Market by Coat Type (Base Coat, Electro Coat, Clear Coat, Primer) Market by End-users (Original Equipment Manufacturers (OEM), Automotive Refinish) by Gepgraphy.

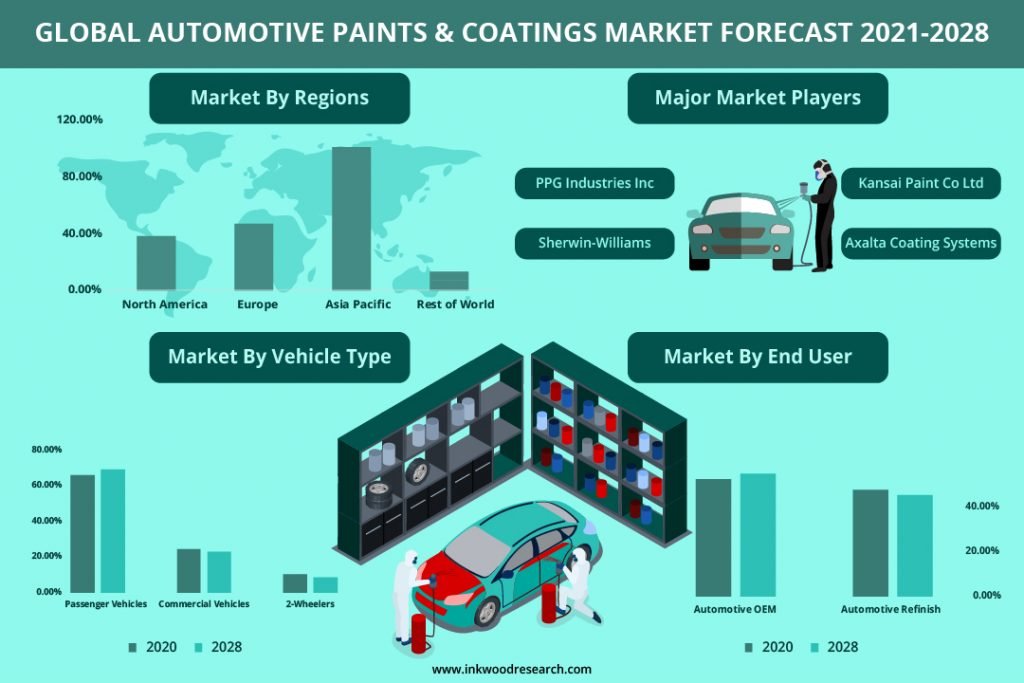

The global automotive paints & coatings market is expected to reach $12.10 billion by 2028, growing at a CAGR of 4.83% during the forecast period. The base year considered for the study is 2020, and the estimated period is between 2021 and 2028. The market study has also analyzed the impact of COVID-19 on the global automotive paints & coatings market qualitatively as well as quantitatively.

To know more about this report, request a free sample copy.

Key enablers propelling the global automotive paints & coatings market growth:

- Proactive government support for automotive industry

- Government regulations aid the private sector of the automobile industry, resulting in public benefits such as greater fuel efficiency. Also, with increased government support, the world’s major automakers have been able to invest in manufacturing plants in growing countries, thus decreasing production costs and increasing profits.

- Some of the augmenting markets include Latin America as well as China, Malaysia, and other Southeast Asian nations. For example, Chinese automakers have sought more government assistance and tie-ups with tech businesses on technologies like software or semiconductors to make China’s smart vehicle supply chain more self-sufficient.

- Furthermore, government policies supporting the automobile sector result in higher output, subsequently leading to higher car demand. As a result, the significant demand for automotive paints & coatings is fueled by the vehicle industry’s expansion and development.

- Growing demand for passenger vehicles

- Rising demand for hygienic automotive interiors

Key growth restraining factors:

- Increasing regulation threats and meeting formulators’ numerous registration requirements

- The automotive paints & coatings market is one of the most highly regulated industries in the world. However, the primary difficulty is the presence of volatile organic compounds (VOCs) in almost all paints & coatings products. VOCs can disturb ecosystems and have debilitating consequences on individuals and the environment depending on the amount and kind of VOCs released. Consequently, the industry’s ongoing problem is replacing them and ensuring consistent performance while decreasing VOC content.

- In addition, the coatings industry observes a growing demand for products that outperform existing options while posing minimal health or environmental risks. However, they also have to comply with regulations. As a result, this has become a formidable challenge even for essential products since the rules are becoming increasingly complicated and demanding.

- Furthermore, creating novel coating technologies that meet the needs of formulators while also keeping up with global regulations and regional market demands has become a challenge to the global automotive paints & coatings market.

- High costs and shortages of raw materials for coatings

The report on the global automotive paints & coatings market includes segmentation analysis on the basis of product type, vehicle type, texture type, coat type, and end-user.

Market by Product Type:

- Water-Borne

- Water-borne is anticipated to be the fastest-growing product type in the market, with an expected CAGR of 5.07%.

- Water-based automobile paints & coatings provide several advantages. While they are safer for the environment, water-borne automotive paints include around 10% solvents, as well.

- As a result of their larger solid content, water-borne paints often cover a car more efficiently than solvent-based paints and need less time for application, thus saving time and money.

- These paints are mainly available in car body paint supply stores. KAPCI Coatings is one of the companies that offer water-borne coatings for automobiles.

- Solvent-Borne

- Other Coatings (Powder Coatings, Etc)

Geographically, the global automotive paints & coatings market has been segmented on the basis of four major regions, which includes:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Russia, Slovakia, Poland, and Rest of Europe

- Asia-Pacific: China, Japan, India, South Korea, Thailand, and Rest of Asia-Pacific

- Asia-Pacific is anticipated to be the largest regional market with a share of 52.93% in 2020.

- In the automobile industry, several nations in the Asia-Pacific area stand out as strong competitors. Countries such as Japan, China, and South Korea are among the top car manufacturing countries in the region. In addition, global vehicle manufacturers such as Fiat Chrysler Automobiles (FCA), Hyundai have also started investing in Asian countries.

- The overall demand and production of passenger vehicles and commercial vehicles are also increasing in the Asia-Pacific. These factors drive the growth of the region’s automotive paints & coatings market.

- Additionally, numerous Asian governments are supporting the adoption of electric vehicles through incentives and tax benefits, thereby fueling the demand for automotive paints & coatings.

- Rest of World: Latin America, the Middle East & Africa

Major players in the global automotive paints & coatings market:

- Axalta Coating Systems

- BASF SE

- Akzo Nobel NV

- Sherwin-Williams

- PPG Industries Inc

- Kansai Paint Co Ltd

Key strategies adopted by some of these companies:

In February 2021, AkzoNobel opened a new R&D center specialized in low cure powder coatings in Como, Italy. Also, in March 2021, Akzo Nobel NV acquired Industrias Titan SAU (Titan Paints) to strengthen its paints business in Spain, making it a leader in the sector. Similarly, in March 2021, BASF signed a multi-year contract with Mercedes-Benz in the Asia-Pacific, extending the company’s long-standing, commercially approved supplier status to Australia, Japan, Malaysia, South Korea, Taiwan, and Thailand. Furthermore, in June 2021, PPG Industries Inc purchased Tikkurila, a leading Nordic paint and coatings company.

Key trends of the global automotive paints & coatings market:

- Novel technologies, such as new resins for ultra-high-performance weathering coatings systems, provide equivalent performance to fluorinated resins at a lower cost. Therefore, new additive technologies are being employed in the coatings production process to improve sustainability.

- The self-healing and self-repair characteristics of the coatings make smart coatings ideal for corrosion prevention, material protection, and other surface enhancement applications. As a result, many companies are working on smart coating technologies. AkzoNobel, for instance, has successfully developed self-healing vehicle refinish coatings, smart anti-fingerprint coatings, and antimicrobial coatings.

- Since consumers prefer nanocoating for their automobiles, several companies are launching new nanocoatings for automobile electronics specially designed for electric cars. For instance, in August 2021, Actnano Inc, a pioneer in protective nanocoatings for automotive and consumer electronics, unveiled Titan, a revolutionary new coating. Titan provides optimum protection for vehicle electronics when exposed to extreme environmental conditions such as water, moisture, salt, and humidity while retaining stability throughout a wide temperature range.

Frequently Asked Questions (FAQs):

- What are the benefits of nanocoatings?

A: Nanocoatings protect vehicles from dust, UV rays, bird droppings, water spots, and scratches. Nanocoatings for cars are also available with a lifetime warranty.

- Which is the fastest-growing vehicle type in the global automotive paints & coatings market?

A: Passenger vehicles are the fastest-growing vehicle type in the global automotive paints & coatings market.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- KEY DRIVERS

- GROWING DEMAND FOR PASSENGER VEHICLES

- PROACTIVE GOVERNMENT SUPPORT FOR AUTOMOTIVE INDUSTRY

- RISING DEMAND FOR HYGIENIC AUTOMOTIVE INTERIORS

- KEY RESTRAINTS

- INCREASING REGULATION THREATS AND MEETING FORMULATORS’ NUMEROUS REGISTRATION REQUIREMENTS

- HIGH COSTS AND SHORTAGES OF RAW MATERIALS FOR COATINGS

- KEY DRIVERS

- KEY ANALYTICS

- IMPACT OF COVID-19 ON AUTOMOTIVE PAINTS & COATINGS MARKET

- KEY MARKET TRENDS

- PORTER’S FIVE FORCES ANALYSIS

- BUYERS POWER

- SUPPLIERS POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY PRODUCT TYPE

- SOLVENT-BORNE

- WATER-BORNE

- OTHER COATINGS (POWDER COATINGS, ETC)

- MARKET BY VEHICLE TYPE

- PASSENGER VEHICLES

- COMMERCIAL VEHICLES

- HEAVY COMMERCIAL VEHICLES

- LIGHT COMMERCIAL VEHICLES

- 2-WHEELERS

- MARKET BY TEXTURE TYPE

- SOLID

- METALLIC

- PEARLESCENT

- OTHER TEXTURE TYPE

- MARKET BY COAT TYPE

- BASE COAT

- ELECTRO COAT

- CLEAR COAT

- PRIMER

- MARKET BY END-USERS

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- AUTOMOTIVE REFINISH

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- SLOVAKIA

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- THAILAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPETITIVE LANDSCAPE

- KEY STRATEGIC DEVELOPMENTS

- MERGERS & ACQUISITIONS

- PARTNERSHIPS & AGREEMENTS

- BUSINESS EXPANSIONS & DIVESTITURES

- COMPANY PROFILES

- AKZO NOBEL NV

- AXALTA COATING SYSTEMS

- BASF SE

- BERGER PAINTS LTD

- CONCEPT PAINTS

- HMG PAINTS LTD

- KANSAI PAINT CO LTD

- KAPCI COATINGS

- KCC CORPORATION

- NATIONAL PAINTS FACTORIES CO LTD

- PPG INDUSTRIES INC

- RED SPOT PAINT

- RPM INTERNATIONAL INC

- SHERWIN-WILLIAMS

- VALSPAR CORPORATION

- KEY STRATEGIC DEVELOPMENTS

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – AUTOMOTIVE PAINTS & COATINGS

TABLE 2: NEW PASSENGER CAR REGISTRATIONS IN TOP COUNTRIES IN 2020

TABLE 3: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY PRODUCT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 4: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY PRODUCT TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 5: GLOBAL SOLVENT-BORNE MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 6: GLOBAL SOLVENT-BORNE MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 7: GLOBAL WATER-BORNE MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 8: GLOBAL WATER-BORNE MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 9: GLOBAL OTHER COATINGS (POWDER COATINGS, ETC) MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 10: GLOBAL OTHER COATINGS (POWDER COATINGS, ETC) MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 11: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY VEHICLE TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 12: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY VEHICLE TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 13: GLOBAL PASSENGER VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 14: GLOBAL PASSENGER VEHICLES MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 15: GLOBAL COMMERCIAL VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 16: GLOBAL COMMERCIAL VEHICLES MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 17: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY COMMERCIAL VEHICLES, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 18: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY COMMERCIAL VEHICLES, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 19: GLOBAL HEAVY COMMERCIAL VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 20: GLOBAL HEAVY COMMERCIAL VEHICLES MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 21: GLOBAL LIGHT COMMERCIAL VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 22: GLOBAL LIGHT COMMERCIAL VEHICLES MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 23: GLOBAL 2-WHEELERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 24: GLOBAL 2-WHEELERS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 25: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY TEXTURE TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 26: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY TEXTURE TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 27: GLOBAL SOLID MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 28: GLOBAL SOLID MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 29: GLOBAL METALLIC MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 30: GLOBAL METALLIC MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 31: GLOBAL PEARLESCENT MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 32: GLOBAL PEARLESCENT MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 33: GLOBAL OTHER TEXTURE TYPE MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 34: GLOBAL OTHER TEXTURE TYPE MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 35: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY COAT TYPE, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 36: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY COAT TYPE, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 37: GLOBAL BASE COAT MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 38: GLOBAL BASE COAT MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 39: GLOBAL ELECTRO COAT MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 40: GLOBAL ELECTRO COAT MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 41: GLOBAL CLEAR COAT MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 42: GLOBAL CLEAR COAT MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 43: GLOBAL PRIMER MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 44: GLOBAL PRIMER MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 45: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY END-USERS, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 46: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY END-USERS, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 47: GLOBAL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 48: GLOBAL ORIGINAL EQUIPMENT MANUFACTURERS (OEM) MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 49: GLOBAL AUTOMOTIVE REFINISH MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 50: GLOBAL AUTOMOTIVE REFINISH MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 51: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 52: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY GEOGRAPHY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 53: NORTH AMERICA AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 54: NORTH AMERICA AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 55: KEY PLAYERS IN NORTH AMERICA AUTOMOTIVE PAINTS & COATINGS MARKET

TABLE 56: PRODUCTION & SALES OF AUTOMOBILES IN UNITED STATES (2016-2020)

TABLE 57: PRODUCTION & SALES OF AUTOMOBILES IN CANADA (2016-2020)

TABLE 58: EUROPE AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 59: EUROPE AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 60: KEY PLAYERS IN EUROPE AUTOMOTIVE PAINTS & COATINGS MARKET

TABLE 61: PRODUCTION & SALES OF AUTOMOBILES IN UNITED KINGDOM (2016-2020)

TABLE 62: PRODUCTION & SALES OF AUTOMOBILES IN GERMANY (2016-2020)

TABLE 63: PRODUCTION & SALES OF AUTOMOBILES IN FRANCE (2016-2020)

TABLE 64: PRODUCTION & SALES OF AUTOMOBILES IN ITALY (2016-2020)

TABLE 65: PRODUCTION & SALES OF AUTOMOBILES IN RUSSIA (2016-2020)

TABLE 66: ANNUAL CAR PRODUCTION IN SLOVAKIA, 2016-2020 (IN MILLIONS)

TABLE 67: PRODUCTION & SALES OF AUTOMOBILES IN POLAND (2016-2020)

TABLE 68: PRODUCTION & SALES OF AUTOMOBILES IN SPAIN (2016-2020)

TABLE 69: PRODUCTION & SALES OF AUTOMOBILES IN NETHERLANDS (2016-2020)

TABLE 70: PRODUCTION & SALES OF AUTOMOBILES IN SWEDEN (2016-2020)

TABLE 71: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 72: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, BY COUNTRY, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 73: KEY PLAYERS IN ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET

TABLE 74: PRODUCTION & SALES OF AUTOMOBILES IN CHINA (2016-2020)

TABLE 75: PRODUCTION & SALES OF AUTOMOBILES IN JAPAN (2016-2020)

TABLE 76: PRODUCTION & SALES OF AUTOMOBILES IN INDIA (2016-2020)

TABLE 77: PRODUCTION & SALES OF AUTOMOBILES IN SOUTH KOREA (2016-2020)

TABLE 78: PRODUCTION & SALES OF AUTOMOBILES IN THAILAND (2016-2020)

TABLE 79: PRODUCTION & SALES OF AUTOMOBILES IN PHILIPPINES (2016-2020)

TABLE 80: PRODUCTION & SALES OF AUTOMOBILES IN TAIWAN (2016-2020)

TABLE 81: PRODUCTION & SALES OF AUTOMOBILES IN MALAYSIA (2016-2020)

TABLE 82: PRODUCTION & SALES OF AUTOMOBILES IN SINGAPORE (2016-2020)

TABLE 83: REST OF WORLD AUTOMOTIVE PAINTS & COATINGS MARKET, BY REGION, HISTORICAL YEARS, 2016-2020 (IN $ MILLION)

TABLE 84: REST OF WORLD AUTOMOTIVE PAINTS & COATINGS MARKET, BY REGION, FORECAST YEARS, 2021-2028 (IN $ MILLION)

TABLE 85: KEY PLAYERS IN REST OF WORLD AUTOMOTIVE PAINTS & COATINGS MARKET

TABLE 86: PRODUCTION & SALES OF AUTOMOBILES IN MEXICO (2016-2020)

TABLE 87: PRODUCTION & SALES OF AUTOMOBILES IN BRAZIL (2016-2020)

TABLE 88: PRODUCTION & SALES OF AUTOMOBILES IN ARGENTINA (2016-2020)

TABLE 89: PRODUCTION & SALES OF AUTOMOBILES IN UNITED ARAB EMIRATES (2016-2020)

TABLE 90: PRODUCTION & SALES OF AUTOMOBILES IN SAUDI ARABIA (2016-2020)

TABLE 91: PRODUCTION & SALES OF AUTOMOBILES IN SOUTH AFRICA (2016-2020)

TABLE 92: LIST OF MERGERS & ACQUISITIONS

TABLE 93: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 94: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY PRODUCT TYPE, IN 2020

FIGURE 6: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY SOLVENT-BORNE, 2021-2028 (IN $ MILLION)

FIGURE 7: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY WATER-BORNE, 2021-2028 (IN $ MILLION)

FIGURE 8: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY OTHER COATINGS (POWDER COATINGS, ETC), 2021-2028 (IN $ MILLION)

FIGURE 9: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY VEHICLE TYPE, IN 2020

FIGURE 10: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY PASSENGER VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 11: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY COMMERCIAL VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 12: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY COMMERCIAL VEHICLES, IN 2020

FIGURE 13: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY HEAVY COMMERCIAL VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 14: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY LIGHT COMMERCIAL VEHICLES, 2021-2028 (IN $ MILLION)

FIGURE 15: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY 2-WHEELERS, 2021-2028 (IN $ MILLION)

FIGURE 16: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY TEXTURE TYPE, IN 2020

FIGURE 17: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY SOLID, 2021-2028 (IN $ MILLION)

FIGURE 18: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY METALLIC, 2021-2028 (IN $ MILLION)

FIGURE 19: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY PEARLESCENT, 2021-2028 (IN $ MILLION)

FIGURE 20: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY OTHER TEXTURE TYPE, 2021-2028 (IN $ MILLION)

FIGURE 21: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY COAT TYPE, IN 2020

FIGURE 22: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY BASE COAT, 2021-2028 (IN $ MILLION)

FIGURE 23: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY ELECTRO COAT, 2021-2028 (IN $ MILLION)

FIGURE 24: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY CLEAR COAT, 2021-2028 (IN $ MILLION)

FIGURE 25: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY PRIMER, 2021-2028 (IN $ MILLION)

FIGURE 26: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, GROWTH POTENTIAL, BY END-USERS, IN 2020

FIGURE 27: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY ORIGINAL EQUIPMENT MANUFACTURERS (OEM), 2021-2028 (IN $ MILLION)

FIGURE 28: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, BY AUTOMOTIVE REFINISH, 2021-2028 (IN $ MILLION)

FIGURE 29: GLOBAL AUTOMOTIVE PAINTS & COATINGS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 30: NORTH AMERICA AUTOMOTIVE PAINTS & COATINGS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 31: UNITED STATES AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 32: CANADA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 33: EUROPE AUTOMOTIVE PAINTS & COATINGS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 34: UNITED KINGDOM AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 35: GERMANY AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 36: FRANCE AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 37: ITALY AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 38: RUSSIA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 39: SLOVAKIA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 40: POLAND AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 41: REST OF EUROPE AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 42: ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 43: CHINA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 44: JAPAN AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 45: INDIA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 46: SOUTH KOREA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 47: THAILAND AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 48: REST OF ASIA-PACIFIC AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 49: REST OF WORLD AUTOMOTIVE PAINTS & COATINGS MARKET, REGIONAL OUTLOOK, 2020 & 2028 (IN %)

FIGURE 50: LATIN AMERICA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

FIGURE 51: MIDDLE EAST & AFRICA AUTOMOTIVE PAINTS & COATINGS MARKET, 2021-2028 (IN $ MILLION)

- MARKET BY PRODUCT TYPE

- SOLVENT-BORNE

- WATER-BORNE

- OTHER COATINGS (POWDER COATINGS, ETC)

- MARKET BY VEHICLE TYPE

- PASSENGER VEHICLES

- COMMERCIAL VEHICLES

- HEAVY COMMERCIAL VEHICLES

- LIGHT COMMERCIAL VEHICLES

- 2-WHEELERS

- MARKET BY TEXTURE TYPE

- SOLID

- METALLIC

- PEARLESCENT

- OTHER TEXTURE TYPE

- MARKET BY COAT TYPE

- BASE COAT

- ELECTRO COAT

- CLEAR COAT

- PRIMER

- MARKET BY END-USERS

- ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

- AUTOMOTIVE REFINISH

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED STATES

- CANADA

- EUROPE

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- SLOVAKIA

- POLAND

- REST OF EUROPE

- ASIA-PACIFIC

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- KEY PLAYERS

- COUNTRY ANALYSIS

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- THAILAND

- REST OF ASIA-PACIFIC

- REST OF WORLD

- MARKET SIZE & ESTIMATES

- KEY DRIVERS

- KEY CHALLENGES

- REGIONAL ANALYSIS

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.