GLOBAL ANTIHYPERTENSIVE DRUGS MARKET FORECAST 2019-2028

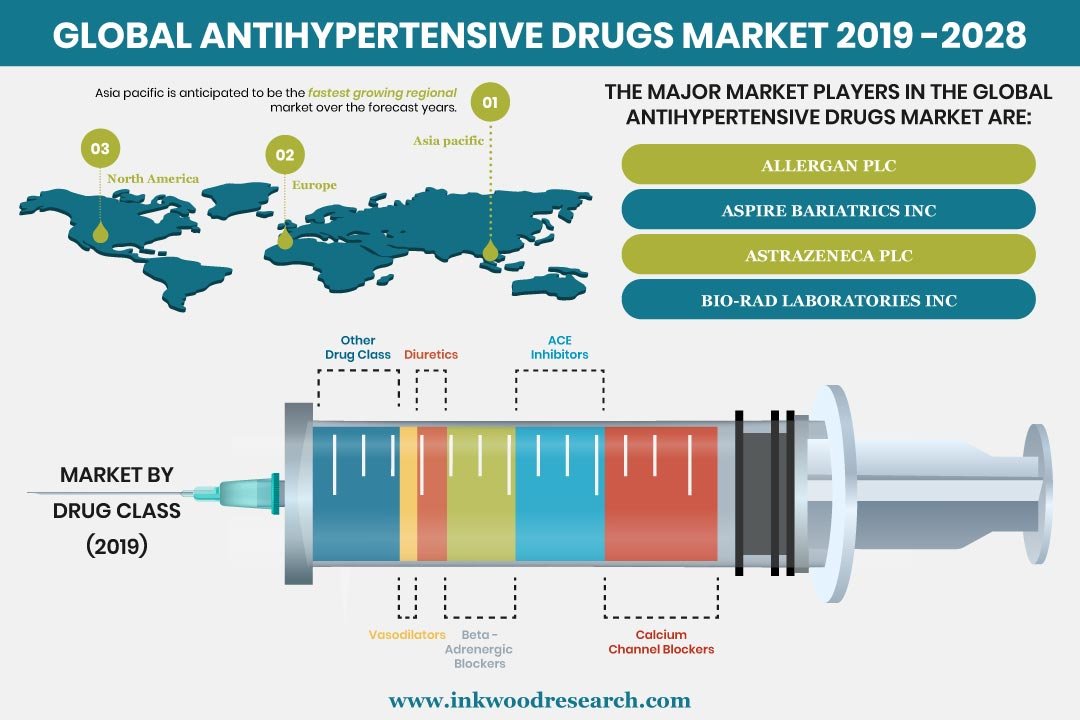

Global Antihypertensive Drugs Market by Drug Class (Calcium Channel Blockers, Ace Inhibitors, Beta-adrenergic Blockers, Diuretics, Vasodilators, Other Drug Class) by End-user (Hospital Pharmacy, Retail Pharmacy, E-commerce Websites & Online Drug Stores) and by Geography.

The global antihypertensive drugs market is anticipated to grow at a CAGR of 3.21%, during the forecast period of 2019 to 2028. The market is estimated to garner a revenue share of $30.9 billion by 2028. Antihypertensive drugs are primarily used to treat patients suffering from hypertension, a long-term medical condition marked by the rise in blood pressure.

Key drivers that fuel the global antihypertensive drugs market growth are:

- Growing prevalence of hypertension across the globe

- Surge in disposable income and healthcare spending

- Rise in the aging population

To know more about this report, request a free sample copy.

Leading factors like the rise in the aging population and the prevalence of hypertension around the world, propel the global antihypertensive drugs market growth. Hypertension has become a significant cause of cardiovascular diseases, worldwide. The geriatric population is highly susceptible to high blood pressure, which is steadily driving the antihypertensive drug market growth.

In 2019, a revenue share of 27.83% was garnered by the calcium channel blockers segment under the drug class category, in the global antihypertensive drugs market. Factors contributing to the growth of calcium channel blockers are a rise in awareness related to the use of antihypertensives for managing and controlling hypertension.

Conversely, the ACE inhibitors segment is anticipated to be the fastest-growing drug class category with a CAGR of 4.69%, by the end of the forecast period. ACE inhibitors are utilized for effectively treating high blood pressure. Moreover, lesser side effects are exhibited by these drugs as compared to other drug classes. This has augmented the demand for antihypertensive drugs, globally.

Major factors hindering the antihypertensive drugs market growth are patent expirations and delays in product launches. Patent expirations lead to the entry of low-priced generics in the market, which restricts market expansion. FDA regulations examine the quality of drug products by carefully monitoring the drug manufacturer’s compliance with current manufacturing practice regulations. However, the approval takes a long time, leading to the delay of new product launches.

The report scope of the global antihypertensive drugs market covers the segmentation analysis of drug class and end-user.

Market by Drug Class:

- Calcium channel blockers

- ACE inhibitors

- Beta-adrenergic blockers

- Diuretics

- Vasodilators

- Other drug class

Market by End-user:

- Hospital pharmacy

- Retail pharmacy

- E-commerce websites and online drug stores

Geographically, the global antihypertensive drugs market is segmented into four major regions, that include:

- North America: The United States & Canada

- Asia Pacific: India, China, Japan, South Korea, Indonesia, Thailand Vietnam, Australia & New Zealand, and Rest of Asia Pacific

- Europe: Germany, The United Kingdom, Italy, France, Belgium, Russia, Poland, and Rest of Europe

- Rest of World: Latin America, the Middle East & Africa

Regionally, North America dominated the global antihypertensive drugs market with a revenue share of 35.02% in 2019. The United States dominated the North America market in 2019, due to the prevalence of hypertension in the region. According to the Centers for Disease Control and Prevention, in 2017, 75 million adults in the United States had high blood pressure. Therefore, the prevalence has led to an upsurge in demand for antihypertensive drugs in the region. The rise in geriatric population in North America, further boosts the adoption of antihypertensive drugs.

The region of Asia Pacific is anticipated to be the fastest-growing region by the end of the forecast period. The presence of a vast patient base is expected to boost the growth of the Asia Pacific antihypertensive drug market. Moreover, an increase in healthcare expenditures integrated with increased awareness of antihypertensive drugs propels the market growth.

Key players in the global antihypertensive drugs market:

- Allergan PLC

- AstraZeneca PLC

- Boehringer Ingelheim International GmbH

- Johnson & Johnson

- Novartis AG

- Others

Key strategies adopted by some of the antihypertensive drugs companies:

In April 2020, Allergan PLC announced that the National Medical Products Administration by China approved the registration of XEN Gel Stent, to supervise patients with refractory glaucoma surgically. AstraZeneca collaborated with ArcherDX in May 2020, to use modified cancer assays, with an intent to recognize minimal residual ailment in lung cancer trials.

Key trends of the global antihypertensive drugs market:

- Calcium Channel Blockers are the largest revenue-generating drug class.

- E-commerce websites & online drug stores are expected to be the fastest-growing end-user market during the forecast period.

- There have been considerable evolutions in the life science industry, especially in developing economies.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- MARKET DEFINITION

- KEY DRIVERS

- GROWING PREVALENCE OF HYPERTENSION ACROSS THE GLOBE

- SURGE IN DISPOSABLE INCOME AND HEALTHCARE SPENDING

- RISING AGING POPULATION

- KEY RESTRAINTS

- PATENT EXPIRATIONS

- DELAY IN PRODUCT LAUNCHES

- KEY ANALYTICS

- PORTER’S FIVE FORCE ANALYSIS

- THREAT OF NEW ENTRY

- THREAT OF SUBSTITUTION

- BUYER’S POWER

- SUPPLIER’S POWER

- COMPETITIVE RIVALRY

- REGULATORY FRAMEWORK

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- MARKET BY DRUG CLASS

- CALCIUM CHANNEL BLOCKERS

- ACE INHIBITORS

- BETA-ADRENERGIC BLOCKERS

- DIURETICS

- VASODILATORS

- OTHER DRUG CLASS

- MARKET BY END-USER

- HOSPITAL PHARMACY

- RETAIL PHARMACY

- E-COMMERCE WEBSITES & ONLINE DRUG STORES

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- ALLERGAN PLC

- ASPIRE BARIATRICS INC

- ASTRAZENECA PLC

- BIO-RAD LABORATORIES INC

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- DAIICHI SANKYO COMPANY LIMITED

- HILL-ROM HOLDINGS INC

- JOHNSON & JOHNSON

- LUPIN LIMITED

- MEDTRONIC PLC

- MERCK & CO INC

- NOVARTIS AG

- PFIZER INC

- SANOFI

- SUN PHARMACEUTICAL INDUSTRIES LTD. (RANBAXY LABORATORIES)

TABLE LIST

TABLE 1: MARKET SNAPSHOT – ANTIHYPERTENSIVE DRUGS

TABLE 2: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY DRUG CLASS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 3: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY DRUG CLASS, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 4: GLOBAL CALCIUM CHANNEL BLOCKERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 5: GLOBAL CALCIUM CHANNEL BLOCKERS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 6: GLOBAL ACE INHIBITORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: GLOBAL ACE INHIBITORS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 8: GLOBAL BETA-ADRENERGIC BLOCKERS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: GLOBAL BETA-ADRENERGIC BLOCKERS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 10: GLOBAL DIURETICS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: GLOBAL DIURETICS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 12: GLOBAL VASODILATORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: GLOBAL VASODILATORS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 14: GLOBAL OTHER DRUG CLASS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: GLOBAL OTHER DRUG CLASS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 16: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY END-USER, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY END-USER, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 18: GLOBAL HOSPITAL PHARMACY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: GLOBAL HOSPITAL PHARMACY MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 20: GLOBAL RETAIL PHARMACY MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: GLOBAL RETAIL PHARMACY MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 22: GLOBAL E-COMMERCE WEBSITES & ONLINE DRUG STORES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: GLOBAL E-COMMERCE WEBSITES & ONLINE DRUG STORES MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 24: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 25: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 26: NORTH AMERICA ANTIHYPERTENSIVE DRUGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 27: NORTH AMERICA ANTIHYPERTENSIVE DRUGS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 28: EUROPE ANTIHYPERTENSIVE DRUGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 29: EUROPE ANTIHYPERTENSIVE DRUGS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 30: ASIA PACIFIC ANTIHYPERTENSIVE DRUGS MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 31: ASIA PACIFIC ANTIHYPERTENSIVE DRUGS MARKET, BY COUNTRY, FORECAST YEARS, 2019-2028 (IN $ MILLION)

TABLE 32: REST OF WORLD ANTIHYPERTENSIVE DRUGS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 33: REST OF WORLD ANTIHYPERTENSIVE DRUGS MARKET, BY REGION, FORECAST YEARS, 2019-2028 (IN $ MILLION)

FIGURE LIST

FIGURE 1: NUMBER OF AGING POPULATION BY REGION 2017& 2050 (IN MILLION)

FIGURE 2: PORTER’S FIVE FORCE ANALYSIS

FIGURE 3: OPPORTUNITY MATRIX

FIGURE 4: VENDOR LANDSCAPE

FIGURE 5: KEY INVESTMENT INSIGHTS

FIGURE 6: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY DRUG CLASS, IN 2019

FIGURE 7: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY CALCIUM CHANNEL BLOCKERS, 2019-2028 (IN $ MILLION)

FIGURE 8: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY ACE INHIBITORS, 2019-2028 (IN $ MILLION)

FIGURE 9: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY BETA-ADRENERGIC BLOCKERS, 2019-2028 (IN $ MILLION)

FIGURE 10: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY DIURETICS, 2019-2028 (IN $ MILLION)

FIGURE 11: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY VASODILATORS, 2019-2028 (IN $ MILLION)

FIGURE 12: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY OTHER DRUG CLASS, 2019-2028 (IN $ MILLION)

FIGURE 13: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY END-USER, IN 2019

FIGURE 14: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY HOSPITAL PHARMACY, 2019-2028 (IN $ MILLION)

FIGURE 15: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY RETAIL PHARMACY, 2019-2028 (IN $ MILLION)

FIGURE 16: GLOBAL ANTIHYPERTENSIVE DRUGS MARKET, BY E-COMMERCE WEBSITES & ONLINE DRUG STORES, 2019-2028 (IN $ MILLION)

FIGURE 17: NORTH AMERICA ANTIHYPERTENSIVE DRUGS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 18: THE UNITED STATES ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 19: CANADA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 20: EUROPE ANTIHYPERTENSIVE DRUGS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 21: THE UNITED KINGDOM ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 22: FRANCE ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 23: GERMANY ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 24: ITALY ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 25: RUSSIA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 26: BELGIUM ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 27: POLAND ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 28: REST OF EUROPE ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 29: ASIA PACIFIC ANTIHYPERTENSIVE DRUGS MARKET, COUNTRY OUTLOOK, 2019 & 2028 (IN %)

FIGURE 30: CHINA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 31: JAPAN ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 32: INDIA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 33: AUSTRALIA & NEW ZEALAND ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 34: SOUTH KOREA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 35: THAILAND ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 36: INDONESIA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 37: VIETNAM ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 38: REST OF ASIA PACIFIC ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 39: REST OF WORLD ANTIHYPERTENSIVE DRUGS MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 40: LATIN AMERICA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

FIGURE 41: MIDDLE EAST & AFRICA ANTIHYPERTENSIVE DRUGS MARKET, 2019-2028 (IN $ MILLION)

- MARKET BY DRUG CLASS

- CALCIUM CHANNEL BLOCKERS

- ACE INHIBITORS

- BETA-ADRENERGIC BLOCKERS

- DIURETICS

- VASODILATORS

- OTHER DRUG CLASS

- MARKET BY END-USER

- HOSPITAL PHARMACY

- RETAIL PHARMACY

- E-COMMERCE WEBSITES & ONLINE DRUG STORES

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- THE UNITED STATES

- CANADA

- EUROPE

- THE UNITED KINGDOM

- FRANCE

- GERMANY

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- SOUTH KOREA

- THAILAND

- INDONESIA

- VIETNAM

- REST OF ASIA PACIFIC

- REST OF WORLD

- LATIN AMERICA

- MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.