GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET FORECAST 2020-2028

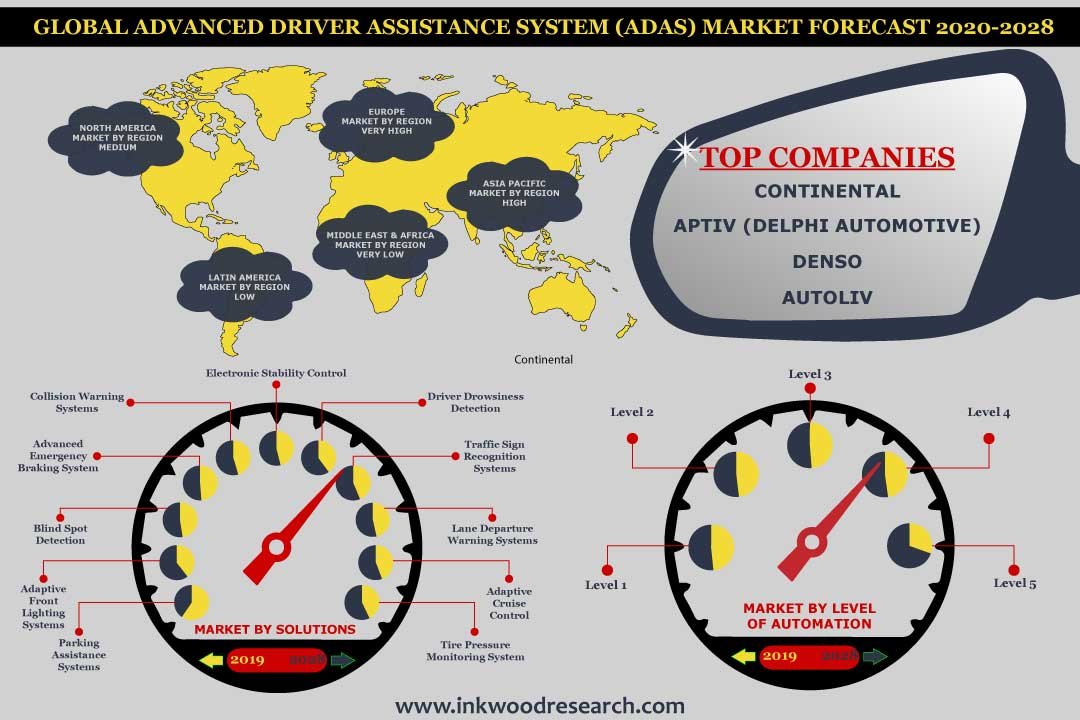

Global Advanced Driver Assistance System (Adas) Market by Vehicle Type (Passenger Cars, Commercial Vehicles) by Component (Processors, Sensors, Software, Other Component) by Level of Automation (Advanced Driving Assist Systems-adas, Partial Automation, Conditional Automation, High Automation, Full Automation) by Solutions (Parking Assistance System, Tire Pressure Monitoring System, Adaptive Front Lighting Systems, Lane Departure Warning Systems, Collision Warning Systems, Blind Spot Detection, Electronic Stability Control, Adaptive Cruise Control, Advanced Emergency Braking System, Traffic Sign Recognition Systems, Driver Drowsiness Detection, Other Solutions) and by Geography.

The global advanced driver assistance system (ADAS) market was valued at $xx billion in 2019, and is expected to reach $60.90 billion by 2028, growing at a CAGR of 14.68% during the forecast period. The base year considered for the study is 2019, and the forecast period is between 2020 and 2028.

Key factors boosting the global advanced driver assistance system (ADAS) market growth are:

- Stringent government regulations

- Higher safety demand from customers

- Increased adoption from the automotive sector

- Growing awareness of the driver assistance system

To learn more about this report, request a free sample copy

To learn more about this report, request a free sample copy

The growing concern about vehicle safety is primarily driving the demand for ADAS. Road accidents are currently a major issue around the world, and it is evaluated that, on average, each road accident results in at least 5 people being seriously injured and 2 people being killed. The U.S. accounts for 35,000 deaths every year due to road accidents. Deaths in China due to accidents have been estimated to be around 260,000. The number of fatal accidents in the U.K. and Japan is estimated to be around 1,700 and 4,000, every year, respectively. Most of these accidents were caused due to the errors made by drivers. These circumstances have encouraged various government initiatives towards minimizing fatalities and increasing the safety standards in new vehicles, which, in turn, has boosted the advanced driver assistance systems market.

Radar sensors, with regard to their robust functionality and multiple applications, dominated the ADAS market by sensor type, accounting for 52.23% of the overall market in 2019. The advantage of radar sensors is their ability to detect objects in bad weather conditions and their insensitivity to dirt deposits. Moreover, new developments in reducing cost, energy utilization, and radar sensor size will be a boost for the market. However, severe health hazards and the need for protective clothing in manufacturing radar systems restrict the production of radar sensors in both, developing and developed nations. Also, the real downside of radar sensors is that it might react too slowly to sudden changes in the road segment ahead. When a sensor’s blind spot is too wide, a vehicle that suddenly comes into view will not be detected or will be detected too late. On the flip side, LiDAR has become a prominent alternative to radar, and it is even is anticipated to be the fastest evolving sensor type. LiDAR has no problem calculating the speed of an oncoming car and now is replacing radar as the first choice for determining car speed by police.

ADAS software malfunctions and the high cost of equipment are the major factors hindering the growth of the market. The ADAS are dependent on semiconductors and sensors in order to function. The ADAS sensors, upon detecting the information, send it to an Electronic Control Unit (ECU), where the data is processed and runs it through an algorithm. The output is directed towards the driver. The limited functionality of the sensors is reducing its reliability. Though the ADAS features help in many ways, the high cost of the equipment remains a restraining factor. Intensive competition & human behavioral adaptation are other major challenges.

The report on the global advanced driver assistance system includes segmentation analysis on the basis of vehicle type, component, level of automation, sensor types, and solutions.

Market by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Market by Component:

- Processors

- Sensors

- Image Sensors

- Ultrasonic Sensors

- Laser Sensors

- Radar Sensors

- Infrared Sensors

- LiDAR

- Software

- Other Components

Market by Level of Automation:

- Level 1

- Level 2

- Level 3

- Level 4

- Level 5

Market by Solutions:

- Parking Assistance System

- Tire Pressure Monitoring System

- Adaptive Front Lighting Systems

- Lane Departure Warning Systems

- Collision Warning Systems

- Blind Spot Detection

- Electronic Stability Control

- Adaptive Cruise Control

- Advanced Emergency Braking System

- Traffic Sign Recognition Systems

- Driver Drowsiness Detection

- Other Solutions

The report also discusses ‘Five levels’ of automotive automation or ADAS levels. These distinct levels provide car makers and developers of sensors and systems for ADAS a way to categorize the new safety systems and the degree and features of driver assistance, which it provides. Further, the report gives a detailed geographic split of the five major markets, which includes:

Geographically, the global advanced driver assistance system market has been segmented on the basis of five major regions, which includes:

- North America: the United States and Canada

- Europe: the United Kingdom, Germany, France, Italy, Russia, Belgium, Poland, and Rest of Europe

- Asia Pacific: China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia & New Zealand, and Rest of Asia Pacific

- Latin America: Brazil, Mexico, Argentina, and Rest of Latin America

- Middle East & Africa: United Arab Emirates, Saudi Arabia, South Africa, and Rest of Middle East & Africa

Geographically, Europe dominated the overall ADAS market, with over 39.54% share in 2019. The European automotive industry is the most-innovative automotive markets in the world. Euro NCAP, the safety certification body, has been working since 2010 towards increasing the adoption of advanced safety techniques. It has launched a program called ‘Euro NCAP Advanced’ and also stated that the cars integrated with ADAS systems will be awarded the top 5-star safety rating. There is primarily a growing demand for highly automated vehicles in Germany and a growing focus towards road safety. At present, the German government is investing in R&D for self-driving technology, thus accelerating the production of high technology components for ADAS and autonomous vehicles. In February 2017, Germany and France planned to test self-driving vehicles on a stretch 70 kilometers (43 miles) of road linking the two countries. Other countries from Europe, such as the Netherlands and Sweden, are also stepping forward to be a part of this revolution. Autonomous vehicles are soon expected to be on the roads of the Netherlands as the legislative body of the Netherlands has allowed the automotive players to test their autonomous vehicles on the road.

The major players in the global advanced driver assistance system (ADAS) market are:

- Continental

- Aptiv (Delphi Automotive)

- Denso

- Autoliv

- Valeo

- Others

Key strategies adopted by some of these companies:

In January 2020, in order to improve the driver’s capability to monitor traffic to the rear and sides of the vehicle, Gentex Corporation, in collaboration with Aston Martin, developed a camera-based rear vision system. In December 2019, Continental AG introduced a system that detects low-speed contact between a vehicle and a person or an object known as Contact Sensor System (CoSSy). In November 2019, Gabo Systemtechnik GmbH was acquired by Aptiv PLC from Bregal Unternehmerkapital.

Similarly, in August 2019, Waymo made available its Open Dataset to researchers. The dataset contains high-resolution sensor data, which is collected by Waymo self-driving vehicles.

Key trends of the global advanced driver assistance system (ADAS) market are:

- With the growing ability of ADAS to detect obstacles and increase safety in travel, the market for ADAS in driverless cars is expected to increase during the forecast period.

- Consumer preference towards safer driving experience and stringent regulations that mandate rules for safety have acted as a major propellant for the growth of the market.

- The Asia Pacific region, with India, Japan, and China as its major automotive hubs, has opened up new opportunities for the growth of the market.

- Major players such as Delphi, Valeo, Denso, Continental, and Aisin, are trying to maintain their dominance in the market by launching innovative products with enhanced safety features.

- RESEARCH SCOPE & METHODOLOGY

- STUDY OBJECTIVES

- SCOPE OF STUDY

- METHODOLOGY

- ASSUMPTIONS & LIMITATIONS

- EXECUTIVE SUMMARY

- MARKET SIZE & ESTIMATES

- MARKET OVERVIEW

- MARKET DYNAMICS

- INTRODUCTION TO ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

- AUTOMATED DRIVING: FIVE LEVELS OF AUTOMOTIVE AUTONOMY

- MARKET DEFINITION

- KEY DRIVERS

- STRINGENT GOVERNMENT REGULATIONS.

- HIGHER SAFETY DEMAND FROM CUSTOMERS

- INCREASED ADOPTION FROM AUTOMOTIVE SECTOR

- GROWING AWARENESS OF DRIVER ASSISTANCE SYSTEM

- KEY RESTRAINTS

- ADAS MALFUNCTIONS

- HIGH COSTS ASSOCIATED WITH ADAS

- INTENSIVE COMPETITION

- HUMAN BEHAVIORAL ADAPTATION

- KEY ANALYTICS

- KEY INVESTMENT INSIGHTS

- PORTER’S FIVE FORCE ANALYSIS

- BUYER POWER

- SUPPLIER POWER

- SUBSTITUTION

- NEW ENTRANTS

- INDUSTRY RIVALRY

- OPPORTUNITY MATRIX

- VENDOR LANDSCAPE

- MARKET BY VEHICLE TYPE

- PASSENGER CARS

- COMMERCIAL VEHICLES

- LIGHT COMMERCIAL VEHICLES

- HEAVY COMMERCIAL VEHICLES

- MARKET BY COMPONENT

- PROCESSORS

- SENSORS

- IMAGE SENSORS

- ULTRASONIC SENSORS

- LASER SENSORS

- RADAR SENSORS

- INFRARED SENSORS

- LIDAR

- SOFTWARE

- OTHER COMPONENT

- MARKET BY LEVEL OF AUTOMATION

- LEVEL 1 (ADVANCED DRIVING ASSIST SYSTEMS-ADAS)

- LEVEL 2 (PARTIAL AUTOMATION)

- LEVEL 3 (CONDITIONAL AUTOMATION)

- LEVEL 4 (HIGH AUTOMATION)

- LEVEL 5 (FULL AUTOMATION)

- MARKET BY SOLUTIONS

- PARKING ASSISTANCE SYSTEM

- TIRE PRESSURE MONITORING SYSTEM

- ADAPTIVE FRONT LIGHTING SYSTEMS

- LANE DEPARTURE WARNING SYSTEMS

- COLLISION WARNING SYSTEMS

- BLIND SPOT DETECTION

- ELECTRONIC STABILITY CONTROL

- ADAPTIVE CRUISE CONTROL

- ADVANCED EMERGENCY BRAKING SYSTEM

- TRAFFIC SIGN RECOGNITION SYSTEMS

- DRIVER DROWSINESS DETECTION

- OTHER SOLUTIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- LATIN AMERICA

- BRAZIL

- MEXICO

- ARGENTINA

- REST OF LATIN AMERICA

- MIDDLE EAST & AFRICA

- UNITED ARAB EMIRATES

- SAUDI ARABIA

- SOUTH AFRICA

- REST MIDDLE EAST & AFRICA

- NORTH AMERICA

- COMPANY PROFILES

- AISIN SEIKI CO LTD

- APTIV PLC (FORMERLY DELPHI AUTOMOTIVE PLC)

- AUTOLIV INC

- BENDIX COMMERCIAL VEHICLE SYSTEMS, LLC

- CONTINENTAL AG

- DENSO CORPORATION

- GENTEX CORPORATION

- HELLA GMBH & CO KGAA

- HYUNDAI MOBIS CO LTD

- INFINEON TECHNOLOGIES AG

- MAGNA INTERNATIONAL INC

- MOBILEYE N.V

- NXP SEMICONDUCTORS N.V

- OMRON CORPORATION

- PANASONIC CORPORATION

- RENESAS ELECTRONIC CORPORATION

- ROBERT BOSCH GMBH

- SAMSUNG ELECTRONICS CO LTD

- TEXAS INSTRUMENTS INCORPORATED

- VALEO S.A.

- WABCO HOLDINGS INC

- ZF FRIEDRICHSHAFEN AG

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS)

TABLE 2: AN OVERVIEW OF ADVANCED DRIVER ASSISTANCE SYSTEMS (ADAS)

TABLE 3: DEFINITIONS & CLASSIFICATION OF AUTOMATED DRIVING LEVELS

TABLE 4: NATIONAL ROAD SAFETY STRATEGIES, PLANS AND TARGETS IN LATIN AMERICAN COUNTRIES

TABLE 5: COMPARISON BETWEEN LIDAR, CAMERA, AND RADAR IN AUTOMOTIVE APPLICATIONS

TABLE 6: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY VEHICLE TYPE, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 7: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY VEHICLE TYPE, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 8: GLOBAL PASSENGER CARS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 9: GLOBAL PASSENGER CARS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 10: GLOBAL LIGHT COMMERCIAL VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 11: GLOBAL LIGHT COMMERCIAL VEHICLES MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 12: GLOBAL HEAVY COMMERCIAL VEHICLES MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 13: GLOBAL HEAVY COMMERCIAL VEHICLES MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 14: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COMPONENT, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 15: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COMPONENT, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 16: GLOBAL PROCESSORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 17: GLOBAL PROCESSORS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 18: GLOBAL SENSORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 19: GLOBAL SENSORS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 20: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SENSOR TECHNOLOGY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 21: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SENSOR TECHNOLOGY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 22: GLOBAL IMAGE SENSORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 23: GLOBAL IMAGE SENSORS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 24: GLOBAL ULTRASONIC SENSORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 25: GLOBAL ULTRASONIC SENSORS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 26: GLOBAL LASER SENSORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 27: GLOBAL LASER SENSORS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 28: GLOBAL RADAR SENSORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 29: GLOBAL RADAR SENSORS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 30: GLOBAL INFRARED SENSORS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 31: GLOBAL INFRARED SENSORS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 32: COMPARATIVE ANALYSIS OF LIDAR WITH OTHER SENSOR TECHNOLOGIES USED IN AUTOMOTIVE APPLICATIONS

TABLE 33: GLOBAL LIDAR MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 34: GLOBAL LIDAR MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 35: GLOBAL SOFTWARE MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 36: GLOBAL SOFTWARE MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 37: GLOBAL OTHER COMPONENT MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 38: GLOBAL OTHER COMPONENT MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 39: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL OF AUTOMATION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 40: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL OF AUTOMATION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 41: GLOBAL LEVEL 1 MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 42: GLOBAL LEVEL 1 MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 43: GLOBAL LEVEL 2 MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 44: GLOBAL LEVEL 2 MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 45: GLOBAL LEVEL 3 MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 46: GLOBAL LEVEL 3 MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 47: GLOBAL LEVEL 4 MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 48: GLOBAL LEVEL 4 MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 49: GLOBAL LEVEL 5 MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 50: GLOBAL LEVEL 5 MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 51: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SOLUTIONS, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 52: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SOLUTIONS, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 53: DEVELOPMENTS IN PARKING ASSISTANCE SYSTEM

TABLE 54: GLOBAL PARKING ASSISTANCE SYSTEM MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 55: GLOBAL PARKING ASSISTANCE SYSTEM MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 56: GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 57: GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 58: GLOBAL ADAPTIVE FRONT LIGHTING SYSTEMS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 59: GLOBAL ADAPTIVE FRONT LIGHTING SYSTEMS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 60: DEVELOPMENTS IN LANE DEPARTURE WARNING SYSTEM

TABLE 61: GLOBAL LANE DEPARTURE WARNING SYSTEMS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 62: GLOBAL LANE DEPARTURE WARNING SYSTEMS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 63: DEVELOPMENTS IN COLLISION WARNING SYSTEM

TABLE 64: GLOBAL COLLISION WARNING SYSTEMS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 65: GLOBAL COLLISION WARNING SYSTEMS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 66: GLOBAL BLIND SPOT DETECTION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 67: GLOBAL BLIND SPOT DETECTION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 68: DEVELOPMENTS IN ELECTRONIC STABILITY CONTROL

TABLE 69: GLOBAL ELECTRONIC STABILITY CONTROL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 70: GLOBAL ELECTRONIC STABILITY CONTROL MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 71: DEVELOPMENTS IN ADAPTIVE CRUISE CONTROL

TABLE 72: GLOBAL ADAPTIVE CRUISE CONTROL MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 73: GLOBAL ADAPTIVE CRUISE CONTROL MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 74: GLOBAL ADVANCED EMERGENCY BRAKING SYSTEM MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 75: GLOBAL ADVANCED EMERGENCY BRAKING SYSTEM MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 76: GLOBAL TRAFFIC SIGN RECOGNITION SYSTEMS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 77: GLOBAL TRAFFIC SIGN RECOGNITION SYSTEMS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 78: COMPANY WISE NOMENCLATURE OF DIFFERENT DRIVER DROWSINESS ALERT SYSTEMS

TABLE 79: GLOBAL DRIVER DROWSINESS DETECTION MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 80: GLOBAL DRIVER DROWSINESS DETECTION MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 81: GLOBAL OTHER SOLUTIONS MARKET, BY REGION, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 82: GLOBAL OTHER SOLUTIONS MARKET, BY REGION, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 83: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY GEOGRAPHY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 84: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY GEOGRAPHY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 85: NORTH AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 86: NORTH AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 87: SALES & PRODUCTION OF AUTOMOBILES IN UNITED STATES, 2014-2018 (IN UNITS)

TABLE 88: SALES & PRODUCTION OF AUTOMOBILES IN CANADA, 2014-2018 (IN UNITS)

TABLE 89: EUROPE ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 90: EUROPE ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 91: SALES & PRODUCTION OF AUTOMOBILES IN UNITED KINGDOM, 2014-2018 (IN UNITS)

TABLE 92: SALES & PRODUCTION OF AUTOMOBILES IN GERMANY, 2014-2018 (IN UNITS)

TABLE 93: SALES & PRODUCTION OF AUTOMOBILES IN FRANCE, 2014-2018 (IN UNITS)

TABLE 94: SALES & PRODUCTION OF AUTOMOBILES IN ITALY, 2014-2018 (IN UNITS)

TABLE 95: SALES & PRODUCTION OF AUTOMOBILES IN RUSSIA, 2014-2018 (IN UNITS)

TABLE 96: SALES & PRODUCTION OF AUTOMOBILES IN BELGIUM, 2014-2018 (IN UNITS)

TABLE 97: SALES & PRODUCTION OF AUTOMOBILES IN POLAND, 2014-2018 (IN UNITS)

TABLE 98: ASIA PACIFIC ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 99: ASIA PACIFIC ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 100: SALES & PRODUCTION OF AUTOMOBILES IN CHINA, 2014-2018 (IN UNITS)

TABLE 101: SALES & PRODUCTION OF AUTOMOBILES IN JAPAN, 2014-2018 (IN UNITS)

TABLE 102: SALES & PRODUCTION OF AUTOMOBILES IN INDIA, 2014-2018 (IN UNITS)

TABLE 103: SALES & PRODUCTION OF AUTOMOBILES IN SOUTH KOREA, 2014-2018 (IN UNITS)

TABLE 104: SALES & PRODUCTION OF AUTOMOBILES IN INDONESIA, 2014-2018 (IN UNITS)

TABLE 105: SALES & PRODUCTION OF AUTOMOBILES IN THAILAND, 2014-2018 (IN UNITS)

TABLE 106: SALES & PRODUCTION OF AUTOMOBILES IN VIETNAM, 2014-2018 (IN UNITS)

TABLE 107: SALES & PRODUCTION OF AUTOMOBILES IN AUSTRALIA, 2014-2018 (IN UNITS)

TABLE 108: SALES & PRODUCTION OF AUTOMOBILES IN NEW ZEALAND, 2014-2018 (IN UNITS)

TABLE 109: LATIN AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 110: LATIN AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 111: SALES & PRODUCTION OF AUTOMOBILES IN BRAZIL, 2014-2018 (IN UNITS)

TABLE 112: SALES & PRODUCTION OF AUTOMOBILES IN MEXICO, 2014-2018 (IN UNITS)

TABLE 113: SALES & PRODUCTION OF AUTOMOBILES IN ARGENTINA, 2014-2018 (IN UNITS)

TABLE 114: MIDDLE EAST & AFRICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, HISTORICAL YEARS, 2016-2019 (IN $ MILLION)

TABLE 115: MIDDLE EAST & AFRICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COUNTRY, FORECAST YEARS, 2020-2028 (IN $ MILLION)

TABLE 116: SALES & PRODUCTION OF AUTOMOBILES IN UNITED ARAB EMIRATES, 2014-2018 (IN UNITS)

TABLE 117: SALES & PRODUCTION OF AUTOMOBILES IN SAUDI ARABIA, 2014-2018 (IN UNITS)

TABLE 118: SALES & PRODUCTION OF AUTOMOBILES IN SOUTH AFRICA, 2014-2018 (IN UNITS)

LIST OF FIGURES

FIGURE 1: ADAS FEATURES, ACTUAL PRICE VERSUS CUSTOMER WILLINGNESS TO PAY (IN USD)

FIGURE 2: KEY INVESTMENT INSIGHTS

FIGURE 3: LIST OF IMPORTANT UN VEHICLE SAFETY REGULATIONS

FIGURE 4: NEW REGULATIONS AND NCAP RATINGS FOR ADAS

FIGURE 5: PORTER’S FIVE FORCE ANALYSIS

FIGURE 6: OPPORTUNITY MATRIX

FIGURE 7: VENDOR LANDSCAPE

FIGURE 8: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, GROWTH POTENTIAL, BY VEHICLE TYPE, IN 2019

FIGURE 9: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY PASSENGER CARS, 2020-2028 (IN $ MILLION)

FIGURE 10: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LIGHT COMMERCIAL VEHICLES, 2020-2028 (IN $ MILLION)

FIGURE 11: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY HEAVY COMMERCIAL VEHICLES, 2020-2028 (IN $ MILLION)

FIGURE 12: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, GROWTH POTENTIAL, BY COMPONENT, IN 2019

FIGURE 13: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY PROCESSORS, 2020-2028 (IN $ MILLION)

FIGURE 14: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SENSORS, 2020-2028 (IN $ MILLION)

FIGURE 15: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, GROWTH POTENTIAL, BY SENSOR TECHNOLOGY, IN 2019

FIGURE 16: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY IMAGE SENSORS, 2020-2028 (IN $ MILLION)

FIGURE 17: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ULTRASONIC SENSORS, 2020-2028 (IN $ MILLION)

FIGURE 18: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LASER SENSORS, 2020-2028 (IN $ MILLION)

FIGURE 19: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY RADAR SENSORS, 2020-2028 (IN $ MILLION)

FIGURE 20: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY INFRARED SENSORS, 2020-2028 (IN $ MILLION)

FIGURE 21: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LIDAR, 2020-2028 (IN $ MILLION)

FIGURE 22: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY SOFTWARE, 2020-2028 (IN $ MILLION)

FIGURE 23: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY OTHER COMPONENT, 2020-2028 (IN $ MILLION)

FIGURE 24: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, GROWTH POTENTIAL, BY LEVEL OF AUTOMATION, IN 2019

FIGURE 25: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 1, 2020-2028 (IN $ MILLION)

FIGURE 26: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 2, 2020-2028 (IN $ MILLION)

FIGURE 27: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 3, 2020-2028 (IN $ MILLION)

FIGURE 28: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 4, 2020-2028 (IN $ MILLION)

FIGURE 29: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LEVEL 5, 2020-2028 (IN $ MILLION)

FIGURE 30: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, GROWTH POTENTIAL, BY SOLUTIONS, IN 2019

FIGURE 31: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY PARKING ASSISTANCE SYSTEM, 2020-2028 (IN $ MILLION)

FIGURE 32: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY TIRE PRESSURE MONITORING SYSTEM, 2020-2028 (IN $ MILLION)

FIGURE 33: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ADAPTIVE FRONT LIGHTING SYSTEMS, 2020-2028 (IN $ MILLION)

FIGURE 34: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY LANE DEPARTURE WARNING SYSTEMS, 2020-2028 (IN $ MILLION)

FIGURE 35: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY COLLISION WARNING SYSTEMS, 2020-2028 (IN $ MILLION)

FIGURE 36: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY BLIND SPOT DETECTION, 2020-2028 (IN $ MILLION)

FIGURE 37: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ELECTRONIC STABILITY CONTROL, 2020-2028 (IN $ MILLION)

FIGURE 38: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ADAPTIVE CRUISE CONTROL, 2020-2028 (IN $ MILLION)

FIGURE 39: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY ADVANCED EMERGENCY BRAKING SYSTEM, 2020-2028 (IN $ MILLION)

FIGURE 40: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY TRAFFIC SIGN RECOGNITION SYSTEMS, 2020-2028 (IN $ MILLION)

FIGURE 41: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY DRIVER DROWSINESS DETECTION, 2020-2028 (IN $ MILLION)

FIGURE 42: GLOBAL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, BY OTHER SOLUTIONS, 2020-2028 (IN $ MILLION)

FIGURE 43: NORTH AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 44: UNITED STATES ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 45: CANADA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 46: EUROPE ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 47: UNITED KINGDOM ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 48: GERMANY ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 49: FRANCE ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 50: ITALY ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 51: RUSSIA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 52: BELGIUM ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 53: POLAND ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 54: REST OF EUROPE ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 55: ASIA PACIFIC ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 56: CHINA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 57: JAPAN ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 58: INDIA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 59: SOUTH KOREA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 60: INDONESIA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 61: THAILAND ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 62: VIETNAM ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 63: AUSTRALIA & NEW ZEALAND ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 64: REST OF ASIA PACIFIC ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 65: LATIN AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 66: BRAZIL ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 67: MEXICO ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 68: ARGENTINA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 69: REST OF LATIN AMERICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 70: MIDDLE EAST & AFRICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, REGIONAL OUTLOOK, 2019 & 2028 (IN %)

FIGURE 71: UNITED ARAB EMIRATES ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 72: SAUDI ARABIA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 73: SOUTH AFRICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

FIGURE 74: REST MIDDLE EAST & AFRICA ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS) MARKET, 2020-2028 (IN $ MILLION)

- MARKET BY VEHICLE TYPE

- PASSENGER CARS

- COMMERCIAL VEHICLES

- LIGHT COMMERCIAL VEHICLES

- HEAVY COMMERCIAL VEHICLES

- MARKET BY COMPONENT

- PROCESSORS

- SENSORS

- IMAGE SENSORS

- ULTRASONIC SENSORS

- LASER SENSORS

- RADAR SENSORS

- INFRARED SENSORS

- LIDAR

- SOFTWARE

- OTHER COMPONENT

- MARKET BY LEVEL OF AUTOMATION

- LEVEL 1 (ADVANCED DRIVING ASSIST SYSTEMS-ADAS)

- LEVEL 2 (PARTIAL AUTOMATION)

- LEVEL 3 (CONDITIONAL AUTOMATION)

- LEVEL 4 (HIGH AUTOMATION)

- LEVEL 5 (FULL AUTOMATION)

- MARKET BY SOLUTIONS

- PARKING ASSISTANCE SYSTEM

- TIRE PRESSURE MONITORING SYSTEM

- ADAPTIVE FRONT LIGHTING SYSTEMS

- LANE DEPARTURE WARNING SYSTEMS

- COLLISION WARNING SYSTEMS

- BLIND SPOT DETECTION

- ELECTRONIC STABILITY CONTROL

- ADAPTIVE CRUISE CONTROL

- ADVANCED EMERGENCY BRAKING SYSTEM

- TRAFFIC SIGN RECOGNITION SYSTEMS

- DRIVER DROWSINESS DETECTION

- OTHER SOLUTIONS

- GEOGRAPHICAL ANALYSIS

- NORTH AMERICA

- UNITED STATES

- CANADA

- EUROPE

- UNITED KINGDOM

- GERMANY

- FRANCE

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- REST OF EUROPE

- ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- SOUTH KOREA

- INDONESIA

- THAILAND

- VIETNAM

- AUSTRALIA & NEW ZEALAND

- REST OF ASIA PACIFIC

- LATIN AMERICA

- BRAZIL

- MEXICO

- ARGENTINA

- REST OF LATIN AMERICA

- MIDDLE EAST & AFRICA

- UNITED ARAB EMIRATES

- SAUDI ARABIA

- SOUTH AFRICA

- REST MIDDLE EAST & AFRICA

- NORTH AMERICA

To request a free sample copy of this report, please complete the form below :

We offer 10% free customization including country-level data, niche applications and competitive landscape with every report.